The Yes Bank and SMBC Deal 2025: Profits, Stake & Future Plans marks a major turning point in India’s banking sector. Japan’s top financial institution, Sumitomo Mitsui Banking Corporation (SMBC), has acquired a 20% stake in Yes Bank for ₹13,483 crore, signaling strong global confidence in the bank’s growth trajectory.

This blog explores the most important highlights of the Yes Bank and SMBC Deal 2025—covering the financial impact, rising profits, improved NPAs, and future strategy. We’ll also look into regulatory developments and the RBI’s policy review following this international investment.

Whether you’re a retail investor, financial analyst, or simply curious about the future of Indian banking, this article provides key insights into Yes Bank’s current standing and its long-term outlook.

Why did Yes Bank’s share price fall sharply after 2018?

Yes Bank’s share price fell sharply after 2018 due to several reasons.

The primary cause was the bank’s deteriorating financial health and a rise in non-performing assets (NPAs).

In September 2018, the Reserve Bank of India (RBI) limited the tenure of Yes Bank’s founder and CEO Rana Kapoor, which led to a loss of investor confidence.

Additionally, management changes and the need for recapitalization created uncertainty in the market.

These factors caused a significant drop in Yes Bank’s market capitalization and a sharp decline in its share price.

YES BANK LTD-2018

Flashback: The Glorious Days of Yes Bank-

August 20, 2018: Yes Bank’s Share Price Peak

- Share Price: On August 20, 2018, Yes Bank’s shares reached a high of ₹404, marking a significant milestone for the bank.

- Market Capitalization: On the same day, the bank’s market capitalization touched ₹91,000 crore, an important figure at that time.

- Beginning of Decline: September 2018

- RBI’s Decision: In September 2018, the Reserve Bank of India (RBI) limited the tenure of Yes Bank’s founder and CEO Rana Kapoor to January 31, 2019. This came despite the bank’s board recommending a three-year extension of his term.

- Share Price Drop: Following this announcement, on September 21, 2018, Yes Bank’s shares fell by 34%, one of the largest single-day declines for the stock at that time.

- Continued Decline and Investor Sentiment

- Market Cap Fall: Between August 20, 2018, and the end of September 2018, Yes Bank’s market capitalization nearly halved, dropping from ₹91,000 crore to ₹47,000 crore.

- Investor Losses: This steep decline caused significant losses for investors and raised questions about the bank’s credibility.

Yes Bank hit its highest share price level on August 20, 2018, but subsequent regulatory decisions and other factors led to multiple challenges for the bank. This episode serves as a critical example in the banking sector of how management decisions and regulatory interventions can greatly impact a bank’s financial health and investor confidence.

CHART-Yes Bank Ltd

The securities quoted are for illustration only and are not recommendatory. This content is purely for educational and understanding purposes only.

YES BANK LTD-2025

1. SMBC Acquires 20% Stake in Yes Bank

Japan’s Sumitomo Mitsui Banking Corporation (SMBC) has agreed to buy a 20% stake in Yes Bank for ₹13,483 crore.

Out of this, 13.19% stake will be bought from SBI (State Bank of India) and the remaining 6.81% from other banks like ICICI, Axis, and HDFC.

Sumitomo Mitsui Banking Corporation (SMBC) is a leading Japanese bank offering corporate and investment banking services globally. It has branches in India across Delhi, Mumbai, Chennai, and GIFT City.

Global Overview of SMBC

Establishment: SMBC was founded in 2001 through the merger of The Sumitomo Bank and The Sakura Bank.

Headquarters: Tokyo, Japan.

Employees: Approximately 28,000 employees.

Services: SMBC offers banking, leasing, securities, credit cards, investment management, insurance, and other financial services.

SMBC Branches in India:

New Delhi Branch: Worldmark 3, Hospitality District, Aerocity, New Delhi 110037

Mumbai Branch: Platina Building, Bandra Kurla Complex, Mumbai 400051

Chennai Branch: Chaitanya Imperial Tower, Anna Salai, Chennai 600018

GIFT City Branch: Brigade International Financial Center, Gandhinagar 382355

After this deal, SMBC will become the largest shareholder in Yes Bank.

SBI’s stake will reduce to just 10.8%.

This is one of the biggest foreign investments in the Indian banking sector so far.

A stake means ownership or share in a company or project. When someone buys shares, they hold a stake in that company.

3. Strong Profit Growth & Lower NPA

Yes Bank reported a 92.3% jump in net profit, reaching ₹2,406 crore in FY25.

The bank also reduced its Gross NPA (bad loans) to just 1.6%, showing improved asset quality.

NPA (Non-Performing Asset) is a loan on which the borrower has not paid interest or principal for 90 days or more. Banks treat it as a bad loan or stressed asset.

4. Mutual Funds Increased Holding in April

In April 2025, 53 mutual funds bought shares of Yes Bank, while only 14 sold.

Overall, mutual funds added 5.9 crore shares.

Kotak Equity Arbitrage Fund was the top buyer with 2.6 crore shares.

5. Regulatory Approvals Pending

This SMBC–Yes Bank deal still needs approval from RBI, the Competition Commission of India, and Yes Bank’s shareholders.

Final clearance is expected by September 2025.

6. Future Strategy of Yes Bank

Yes Bank has set a target of 13–14% loan growth and 17–18% deposit growth in FY25.

It will now focus more on retail, SME (small business) and microfinance sectors, and expand its branch network.

7. RBI Reviewing Ownership Rules

Due to this major foreign investment, the RBI is reviewing rules related to bank ownership and licensing, to ensure financial system stability.

Yes Bank’s Financial Comeback

Revenue Growth:

| Year | Revenue (₹ Cr) |

| FY21 | ₹339 |

| FY25 | ₹398 |

What is Revenue Growth?

Revenue Growth means how much a company’s sales or income has increased over time.

It shows whether the company is growing its business or not.

| Year | Revenue (₹ Cr) |

|---|---|

| FY21 | ₹339 Cr |

| FY25 | ₹398 Cr |

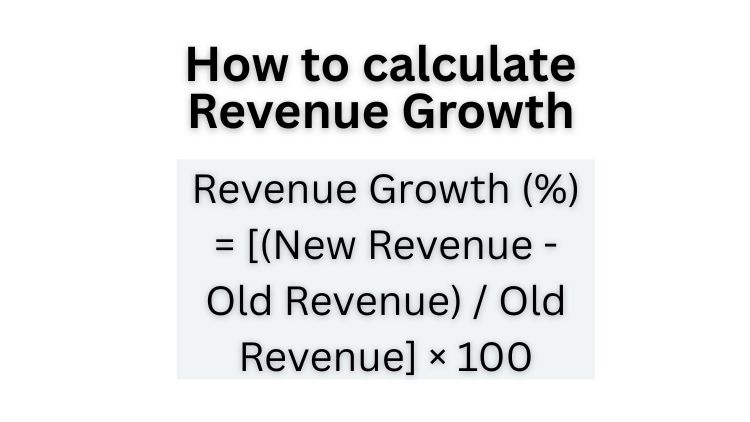

How to calculate Revenue Growth:

Revenue Growth (%) = [(New Revenue – Old Revenue) / Old Revenue] × 100

So here:

= [(₹398 – ₹339) / ₹339] × 100

= (₹59 / ₹339) × 100

≈ 17.4%

From FY21 to FY25, the company’s revenue grew by approx. 17.4%,

which means the company is growing its sales over these years — a positive sign for investors.

Profit Turnaround:

| Year | Net Profit / Loss (₹ Cr) |

| FY21 | ₹-3,489 (Loss) |

| FY25 | ₹447 (Profit) |

In simple words, the company was losing money before but is now earning money.

| Year | Net Profit / Loss (₹ Cr) |

|---|---|

| FY21 | ₹-3,489 (Loss) |

| FY25 | ₹447 (Profit) |

What this means:

- In FY21, the company had a huge loss of ₹3,489 crore.

- In FY25, the company is making a profit of ₹447 crore.

The company has turned around from big losses to profits, which is a very positive sign for investors.

| Year | EPS |

| FY21 | -1.65 |

| FY25 | +0.79 |

What is EPS (Earnings Per Share)?

EPS shows how profitable a company is for each share you own. It’s a key metric for investors.

In simple words:

If a company earns ₹100 in profit and has 100 shares,

then EPS = ₹100 ÷ 100 = ₹1 per share

| Year | EPS |

|---|---|

| FY21 | -1.65 |

| FY25 | +0.79 |

Meaning:

- In FY21, EPS was -1.65 → The company made a loss of ₹1.65 per share.

- In FY25, EPS is +0.79 → The company is expected to make a profit of ₹0.79 per share.

The Yes Bank and SMBC Deal 2025: Profits, Stake & Future Plans -Conclusion:

These updates clearly show that Yes Bank is gaining strength, and the confidence shown by global players like SMBC is a positive sign.

If you are planning to invest in Yes Bank, these developments are very important to know.

Yes Bank shares are currently in the accumulation zone, where investors are gradually buying. In this phase, the stock price remains stable with potential for future growth.

YES BANK Technical Analysis (May 2025)

YES BANK Weekly Chart Analysis (as of May 25, 2025)

| Parameter | Observation |

|---|---|

| Current Price | ₹21.15 |

| Timeframe | 1 Week (W1) |

| Trend Structure | Forming Higher Lows (HL) after major swing Low — indicating early bullish reversal |

| Support Trendline | Strong ascending trendline from ₹12 (since 2021) holding well |

| Key Support Zones | ₹19.56.00 (Major Weekly Support) |

| Key Resistance Zones | ₹22.02 (Near-term), ₹24.80–₹25.50 (Medium-term), ₹32.35 (200 EMA area) |

| Moving Averages | Price crossed above 50 EMA (blue) → bullish sign Still below 200 EMA (red) |

| Chart Pattern | Reversal pattern forming after correction from 2024 High (~₹32) |

| Volume Insight | Buying volume rising near support zone; accumulation in progress |

| Price Action | Price bounced from the long-term support trendline with strong green candles |

| Short-term View | Bullish as long as it stays above ₹22 |

| Medium-term View | A breakout above ₹24.80 can lead to ₹28–₹30 zone retest |

YES BANK LTD – DAILY CHART

Chart Source: TradingView | Timeframe: 1D

| Technical Parameter | Details |

|---|---|

| Current Market Price | ₹21.15 |

| Trend Structure | Forming Higher Highs & Higher Lows (Bullish trend developing) |

| Support Levels | ₹20.63 (Immediate), ₹18.60 (Major support) |

| Resistance Levels | ₹22.02 (Minor), ₹23.40 (Major resistance) |

| Price Action | Price has sustained above 200 DMA; breakout followed by healthy consolidation |

| RSI (Momentum) | 65–70 → Indicates strong bullish momentum |

| Volume Analysis | High volume during breakout; currently consolidating on lower volumes |

| Moving Averages | Price > 50-DMA > 200-DMA (Golden Cross setup) |

| Short-Term View | Bullish as long as price holds above ₹20.00 |

| Risk Assessment | Medium Risk — keep SL below ₹20.00 support |

Key Takeaways from Chart

- A Higher High – Higher Low pattern confirms bullish trend reversal.

- ₹20.63 is now acting as a strong support level.

- ₹22.20 – ₹23.40 is a near-term resistance zone — profit booking possible there.

- Strong RSI and volume suggest positive sentiment.

Is Yes Bank safe for investment in 2025?

Investing in Yes Bank in 2025 requires careful consideration.

The bank has taken several steps in recent years to improve its financial condition, including raising capital and restructuring its management.

Under RBI supervision, Yes Bank’s stability has improved, but risks still remain, especially if economic conditions change.

Therefore, it is important to consult a financial advisor and analyze the bank’s latest financial reports and market conditions before investing.

While there may be long-term investment opportunities, understanding the risks is essential before making any decision.

Has Yes Bank recovered after the 2020 crisis?

Yes, the bank has shown gradual recovery but still faces some challenges.

What is the current status of Yes Bank in 2025?

Yes Bank is stable and expanding with improved financial performance.

Tata Steel Share Price Breakout: Q4 Results & 2025 Outlook

Disclaimer: All content shared by STOCK OVERVIEW is purely for educational and informational purposes. We do not provide any investment advice or recommendations. Always seek guidance from a qualified financial advisor before making any trading or investment decisions. We are not liable for any financial gains or losses based on the information shared.

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.