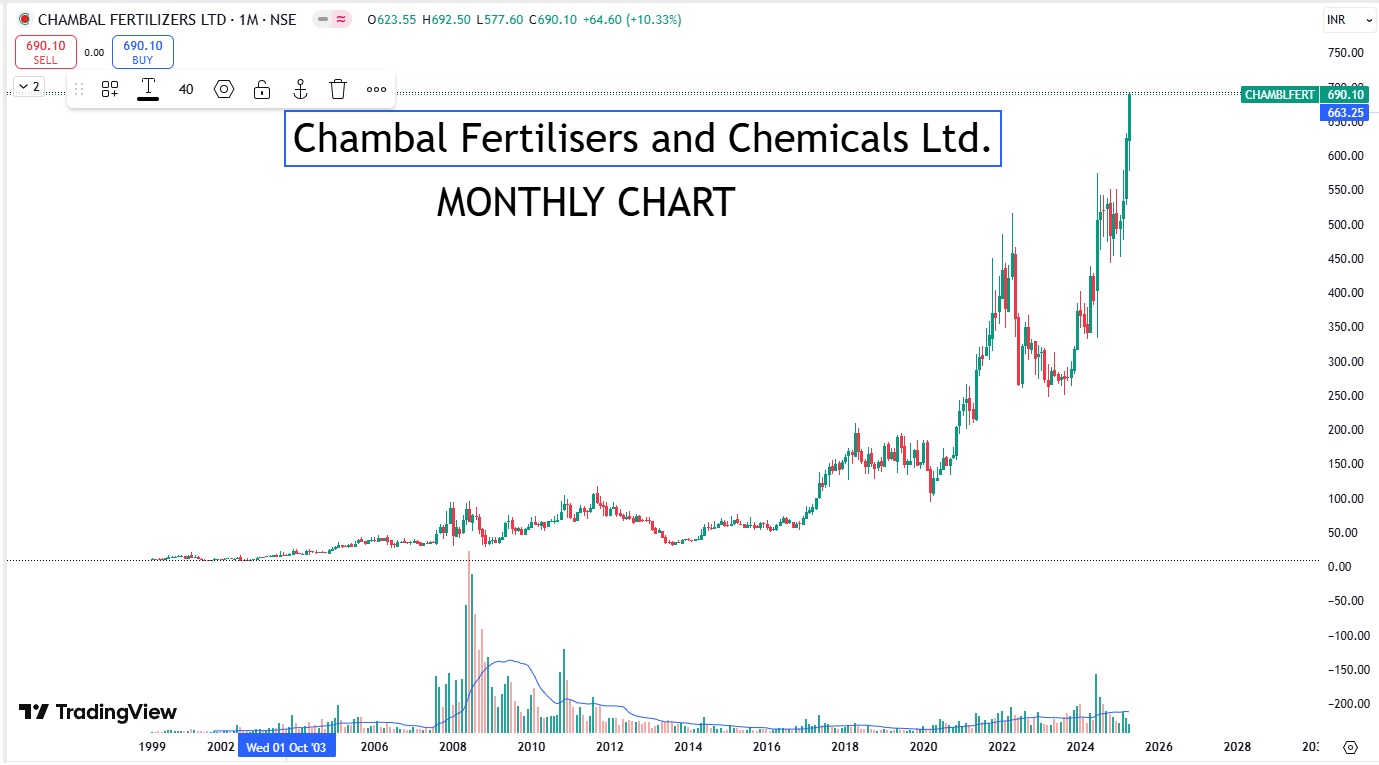

Will Chambal Fertilisers shares skyrocket by 2030? Uncover the 2025–2030 price target, breakout chart & must-know investment insights—before the next big move!

Before making any investment decision, let’s understand all the key aspects of the Chambal Fertilisers Share Price Target 2025–2030 in a simple and informative way.

Company Overview

- Name: Chambal Fertilisers and Chemicals Ltd.

- Incorporated: May 1985 (Originally as Aravali Fertilisers Ltd.)

- Headquarters: Kota, Rajasthan, India

- Promoter / Group: Adventz Group (formerly KK Birla Group)

Chambal Fertilisers is one of India’s largest private-sector fertilizer producers, mainly engaged in manufacturing urea and other agri-input products essential for crop productivity.

Chambal Fertilisers & Chemicals Ltd.

Quick Overview

Updated: Data as of 21 April 2025

Weekly Data Snapshot :

| Parameter | Value |

|---|---|

| Current Closing | 673.60 |

| Previous Closing | 645.25 |

| Weekly Change (Price) | +₹28.35 |

| Weekly Change (%) | +4.39% |

| Support Levels | ₹588 – ₹577 |

| Resistance Levels | No historical barrier |

| Pattern Detected | Consolidation Zone Breakout |

| Chart | Candlestick Chart |

| Candlestick Pattern | Bullish Engulfing |

| Volume | Average Weekly Volume |

| Trend Indicator(MACD) | Bullish Crossover (Weekly) |

| Weekly (RSI) | 72.36 (Bullish) – Weekly |

| Entry Indicator (RSI) | 70.56 (Bullish) – Daily |

| Entry Indicator(Stochastic) | 94.11(Rising) PCO – Daily |

| Divergence | N/A |

| EMA | Above all EMA |

| Outlook | Positive above ₹660 |

| Downtrend’s Lowest Level | ₹248.40 |

Sources: TradingView

How to Calculate Price and Percentage Change

| Current Weekly Closing = ₹673.60 |

| Previous Weekly Closing =₹645.25 |

| Price Change: |

| = Current Closing − Previous Closing |

| = ₹673.60 – ₹645.25 |

| =₹28.35 |

| Percentage Change: |

| = (Price Change ÷ Previous Closing) × 100 |

| = (28.35 ÷ 645.25) × 100 |

| = 4.39% |

| So, the market increased by ₹28.35 or 4.39% this week. |

Chambal Fertilisers & Chemicals Ltd. (CFCL) – Fundamental Snapshot

Updated: 21 April 2025

| Parameter | Value |

|---|---|

| Current Price | ₹690.00 |

| Market Capitalization | ₹27,645 Cr |

| P/E Ratio (TTM) | 17.10 |

| EPS (TTM) | ₹40.3 |

| Book Value per Share | ₹205.00 |

| Price to Book (P/B) | 3.39 |

| Dividend Yield | 1.11% |

| Return on Equity (ROE) | 17.0% |

| Return on Capital Employed (ROCE) | 20.2% |

| Debt / Equity Ratio | 0.25 |

| Promoter Holding | 60.95% |

| FII Holding | 20.20% |

| DII Holding | 4.59% |

| Public Holding | 14.80% |

Important Points

- Valuation: P/E ratio of 17.0 suggests the stock is reasonably valued compared to industry peers.

- Profitability: ROE of 17.0% and ROCE of 20.2% indicate strong profitability.

- Dividend: Consistent dividend payout with a yield of 1.11%.

- Shareholding Pattern: Stable promoter holding at 60.95% with significant FII and DII participation.

- Financial Health: Low debt-to-equity ratio of 0.25 reflects a solid financial position.

Sources: Screener

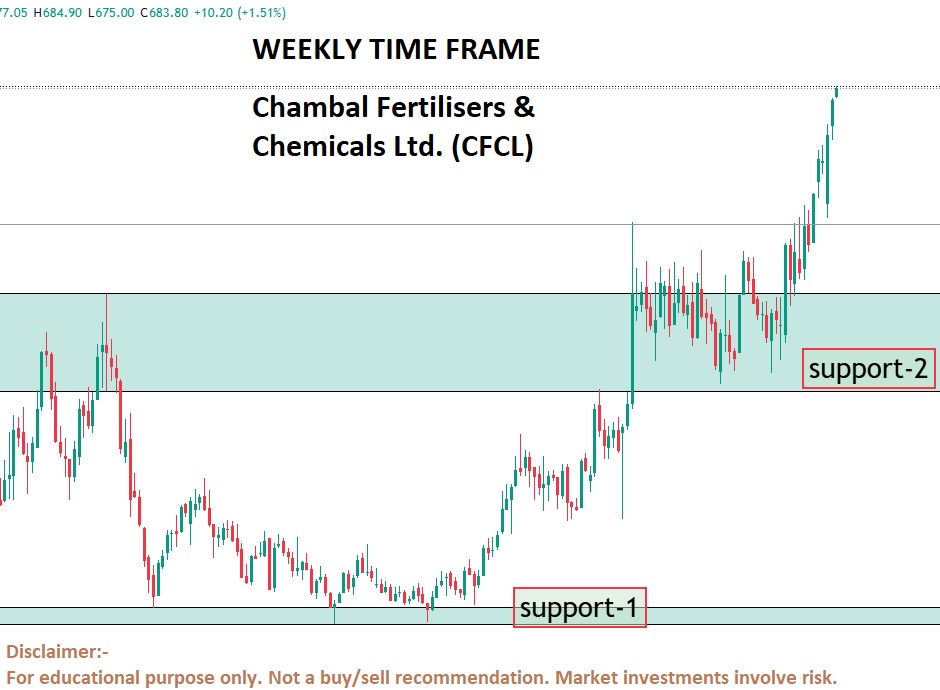

Chart Pattern Analysis – Weekly Time Frame (CFCL)

Key Characteristics of This Pattern:

Data as of 21 April 2025

| Point | Description |

| Pattern Type | Bullish Continuation Pattern (possible Cup & Handle breakout forming) |

| Frequency | Medium (occurs after consolidation) |

| Requirement | Breakout after consolidation above resistance zone and moving averages |

| Chart Type | Candlestick Chart |

| Psychology | Buyers are gaining confidence as price holds above moving averages with volume |

Highlights

- Price is trading above EMA levels (Bullish structure)

- Sufficient volume confirms strength behind the move

- MACD and RSI both are in bullish zone

- Previous resistance is broken; no major resistance ahead (open upside)

This data is based on technical indicators and market behavior as of 21 April 2025. The weekly time frame chart of Chambal Fertilisers & Chemicals Ltd. (CFCL) shows a strong bullish breakout above previous resistance with price trading above key moving averages.

Major Support

When a price touches a level 3-4 times and bounces back upwards each time, this level becomes a strong support. If the price stays at the same place for a long time and the trading volume is also good there, then this support becomes even stronger.

or

When consolidation, resistance, and support all happen at the same level, it becomes a strong price zone and may act as a major support or resistance.

Moving Averages Overview (EMA)

Standard EMAs Used Globally and in India

| Time Frame-Short-Term |

| Common EMA Periods-5, 9, 13, 20, 26 |

| Usage-Retail traders & swing traders prefer these for short-term trend direction |

| Mid-Term |

| 50, 100 |

| Used to filter medium-term support/resistance |

| Long-Term |

| 150, 200, 240 |

| Institutional investors & foreign analysts track these for trend reversals & macro view |

Standard EMAs Used in TradingView (Free Version)

When it happens:

- Price: Trading above short-term and long-term EMAs (e.g., 20 EMA, 50 EMA, 100 EMA)

- Trend Indication: Strong bullish momentum

What it indicates:

When the stock price stays consistently above key moving averages, it suggests an uptrend is in place. This can act as a dynamic support, and traders may look for bullish entries on dips.

Example (from current chart):

Chambal Fertilisers is currently trading above 20 EMA, 50 EMA, and 100 EMA on the weekly chart. This alignment of EMAs below the price confirms a bullish structure and supports the ongoing upside momentum.

Why is Volume important in technical analysis?

Because volume confirms trends.

Rising price + high volume = Strong move

Rising price + low volume = Weak or unsustainable move

Types of Volume (Trading)

| Volume Term | Meaning |

| High Volume | Indicates strong buying or selling pressure; often supports breakouts. |

| Average Volume | Normal participation; useful for trend assessment during sideways markets. |

| Low Volume | Weak activity; unreliable for confirming trends or breakouts. |

| Good Volume | Healthy and consistent participation, often seen in trending markets. |

| More Than Average Volume | Stronger than usual; can signal potential breakout or increased interest. |

Frequently Asked Questions (FAQs) on Technical Analysis

Is Chambal Fertilisers a government company?

No, Chambal Fertilisers & Chemicals Ltd. is a private-sector company and is not owned by the government.

What are the growth drivers for Chambal Fertilisers?

Key growth drivers include rising demand for food, government subsidies, strong rural consumption, increasing fertilizer usage, and strategic capacity expansion.

You can check live prices on NSE, BSE, Moneycontrol, Screener.in, or TradingView.

CFCL – Yearly Target Outlook (2025–2030)

Updated: April 2025

| Year | Projected Target (₹) |

|---|---|

| 2025 | 750+ |

| 2026 | 850 – 900 |

| 2027 | 950 – 1000 |

| 2028 | 1050 – 1100 |

| 2029 | 1150 – 1200 |

| 2030 | 1250 – 1300+ |

These targets are projections based on current data trends and market conditions as of April 2025.

Investors should track quarterly results, global fertilizer prices, and government policies for updated guidance.

| Key Drivers | Progress Outlook |

| Bullish breakout, Strong fundamentals, Higher urea demand | Positive Momentum |

| Govt. support, Fertilizer subsidies, Expansion projects | Govt. support, Fertilizer subsidies, Expansion projects |

| Consistent profitability, Agro-sector demand | Steady Growth |

| Exports, Technology upgrades, Volume growth | Bullish Continuation |

| New product lines, Strategic partnerships | Sustainable Expansion |

| Market leadership, Diversification, Global demand | Long-Term Strong |

These projections are based on current trend analysis, technical breakout, and long-term sector growth. Subject to market risks.

Target Calculation Using Fundamentals (EPS & PE Based)

| For Example |

| We’ll need: |

| Current EPS (TTM) = ₹40.3 |

| Current P/E Ratio = 17.10 |

| Assumed Annual EPS Growth Rate = Let’s assume 10% CAGR (a reasonable estimate for a growing company) |

| Time Frame = 5 Years (2025 to 2030) |

| Expected P/E Ratio (same as current) = 17.10 |

| Step 1: Calculate Future EPS |

| Step 1: Future EPS=40.3×(1+0.10)5=40.3×1.61051=₹64.88 |

| Step 2: Apply Expected P/E to Future EPS |

| Target Price=₹64.88×17.10≈₹1,109.43 |

| Final EPS-Based Target (By 2030): |

| ₹1,100 – ₹1,120 (approx) |

| Note: |

| This target is based on consistent earnings growth of 10% per year. |

| If growth is higher or lower, target will adjust accordingly. |

| Always combine with chart patterns, sector outlook, and macro trends for better accuracy. |

Conclusion-

(Chambal Fertilisers Share Price Target 2025–2030)- According to market experts, Chambal Fertilisers (CFCL) could reach ₹1300+ by 2030. However, investors should monitor market changes for better risk management.

Sources:

Read More

Nifty 50 Weekly Outlook – Important Update April 19, 2025

Nifty 50 Share Price Target 2025 |Crash or Recovery?

Silver Share Price Target 2025: Analysis and outlook

Gold Price Forecast 2025: अब सोने में निवेश करें या इंतजार ?

Crude Oil Share Price Target 2025| Analysis & Outlook

NSE Website update 2025: जानें Best फीचर्स और बदलाव

Intraday to Delivery: Avoid This Big Mistake!

ETFs Share Price Target 2025 – Buy Low, Sell High Strategy

Why Are ETFs Best for Swing Trading?

Are ETFs like mutual funds? free education 2025

ETF से Risk-Free कमाई के Best Secrets

Disclaimer: This blog is for educational purposes only I am just sharing my personal view as a trader and does not constitute financial advice. Please consult your financial advisor before making any trading or investment decisions. Trading in Equity market involves risk.The author shall not be held responsible for any profit or loss incurred as a result of acting on the information provided in this blog.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Contents

- 1 Chambal Fertilisers & Chemicals Ltd.

- 2 How to Calculate Price and Percentage Change

- 3 Chart Pattern Analysis – Weekly Time Frame (CFCL)

- 4 Highlights

- 5 Major Support

- 6 Moving Averages Overview (EMA)

- 7 Why is Volume important in technical analysis?

- 8 Frequently Asked Questions (FAQs) on Technical Analysis

- 9 CFCL – Yearly Target Outlook (2025–2030)

- 10 Target Calculation Using Fundamentals (EPS & PE Based)