It’s an investment product that trades on the stock exchange just like a regular share. An ETF tracks an index (like Nifty or Sensex), a sector, commodity (like Gold), or even bonds. When you buy an ETF, you are investing in multiple stocks or assets at once — through a single unit.

In this blog, we’ll explain what the DSP Nifty Top 10 Equal Weight ETF is, whether now is the right time to buy it, and provide a detailed analysis to help you make an informed investment decision.

To understand the DSP Nifty Top 10 Equal Weight ETF, you first need to understand the meaning of market capitalization and weightage.

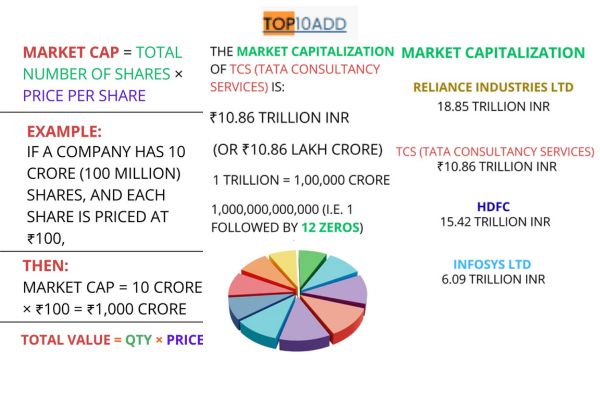

DSP Nifty Top 10 Equal Weight ETF – Market Capitalization –

Market Capitalization refers to the total value of a company in the stock market. It is calculated using the following formula:

Market Cap = Total Number of Shares × Price per Share

Example:

If a company has 10 crore (100 million) shares, and each share is priced at ₹100,

then:

Market Cap = 10 crore × ₹100 = ₹1,000 crore

The larger the company, the higher its market capitalization.

That’s why companies like Reliance, TCS, and HDFC have a very high market cap.

The Market Capitalization of TCS (Tata Consultancy Services) is:₹10.86 Trillion INR (or ₹10.86 Lakh Crore)

1 Trillion = 1,00,000 Crore { 1,000,000,000,000 (i.e. 1 followed by 12 zeros)}

Reliance Industries Ltd – 18.85 trillion INR

HDFC-15.42 trillion INR

DSP Nifty Top 10 Equal Weight ETF – Weightage

When an index (like Nifty 50) is created, each company included in it is given a certain level of importance—this is called Weightage.

In an index based on Market Capitalization:

- Large companies get higher weightage (more influence),

- Smaller companies get lower weightage (less influence).

Meaning:

If Reliance has a very large market cap, it will have the biggest impact on the movement of the Nifty 50 index.

On the other hand, a smaller company will have a limited effect on the index.

DSP Nifty Top 10 Equal Weight ETF – How is an Equal Weight ETF different?

In the DSP Nifty Top 10 Equal Weight ETF, each company is given equal weightage (10%), regardless of whether its market cap is large or small.

The benefit of this approach is that no single company can dominate or control the index, because the movement of the index depends on the weightage assigned to each company.

What is DSP Nifty Top 10 Equal Weight ETF?

DSP Nifty Top 10 Equal Weight ETF is an Exchange Traded Fund (ETF) that aims to replicate the performance of the Nifty Top 10 Equal Weight Index. The fund tries to deliver returns similar to the index, though there may be slight tracking errors.

Let’s also understand the Nifty Top 10 Equal Weight Index, which is tracked by the DSP Nifty Top 10 Equal Weight ETF.

Top 10 Companies in Nifty 50 by Weightage (As on Latest Update)

| Rank | Company Name | Weight (%) |

|---|---|---|

| 1 | ICICI Bank Ltd. | 10.86% |

| 2 | HDFC Bank Ltd. | 10.65% |

| 3 | Larsen & Toubro Ltd. | 10.50% |

| 4 | ITC Ltd. | 10.34% |

| 5 | Bharti Airtel Ltd. | 10.18% |

| 6 | Reliance Industries Ltd. | 9.90% |

| 7 | Infosys Ltd. | 9.76% |

| 8 | Kotak Mahindra Bank Ltd. | 9.40% |

| 9 | Tata Consultancy Services Ltd. | 9.21% |

| 10 | Axis Bank Ltd. | 9.20% |

This index reviews the list of companies every 6 months, and rebalances the weights every 3 months to ensure that each company’s weight remains close to 10%.

Fund Summary DSP Nifty Top 10 Equal Weight ETF

Let’s take a quick glance at the key facts about DSP Equal Weight Fund ETF

| Description | Data |

|---|---|

| Total AUM (Assets) | ₹759.25 crore (as of 30 June 2025) |

| Fund Age | 10 months (launched on 5 September 2024) |

| Expense Ratio | 0.15% (as of 1 August 2025) |

| Exit Load | None |

| Investment Goal | Capital Growth & Income |

| Ideal Holding Period | 10 years or more |

| Portfolio Allocation | Equity: 99.5%, Debt: 0.5% |

| Indian Allocation | 99.55% in Indian stocks |

| Market Cap Focus | 100% Large Cap |

Total AUM – ₹759.25 crore – The fund has crossed ₹759 crore AUM in just 10 months — showing strong investor trust.

Fund Age – 10 months – A newly launched fund (5 Sept 2024), yet showing promising early performance.

Expense Ratio – 0.15% – Ultra-low expense ratio of just 0.15% — meaning minimal cuts from your returns.

No exit load — withdraw your money anytime without any extra charges.

Designed for long-term capital appreciation with added income over time.

Ideal Holding Period – 10 years+ – This fund suits long-term investors — best held for 10 years or more.

Portfolio Allocation – Equity: 99.5%, Debt: 0.5% – Primarily an equity fund — high return potential with higher risk.

Indian Allocation – 99.55% in Indian stocks-Almost entirely invested in Indian equities — participate in India’s growth story.

Market Cap Focus – 100% Large Cap – Focused only on large-cap companies — offering more stability and lower volatility.

DSP Nifty Top 10 Equal Weight ETF- Let’s understand the buying method now

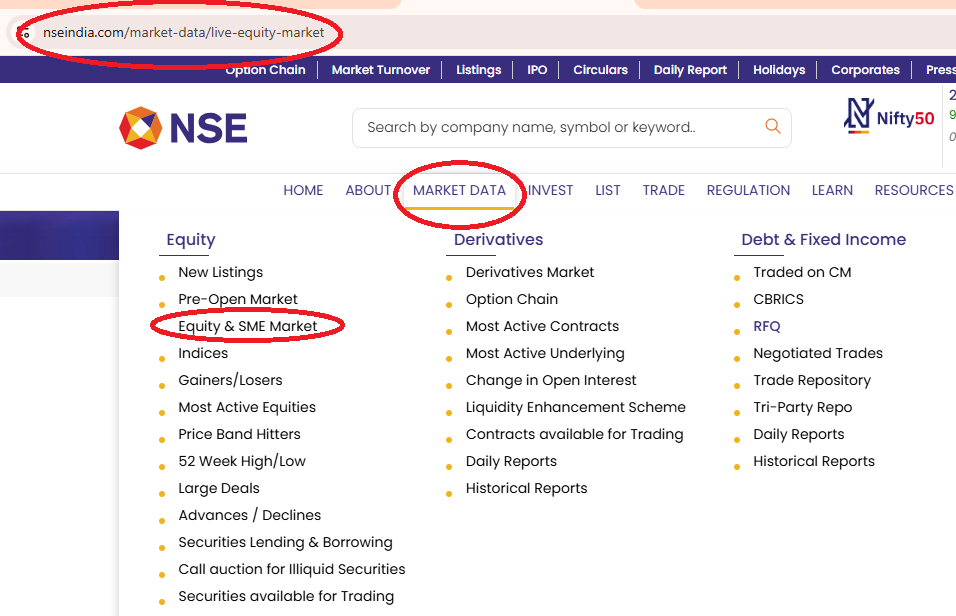

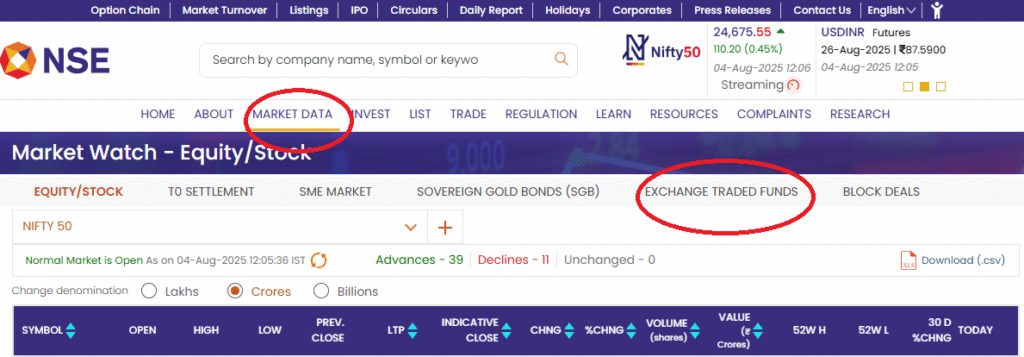

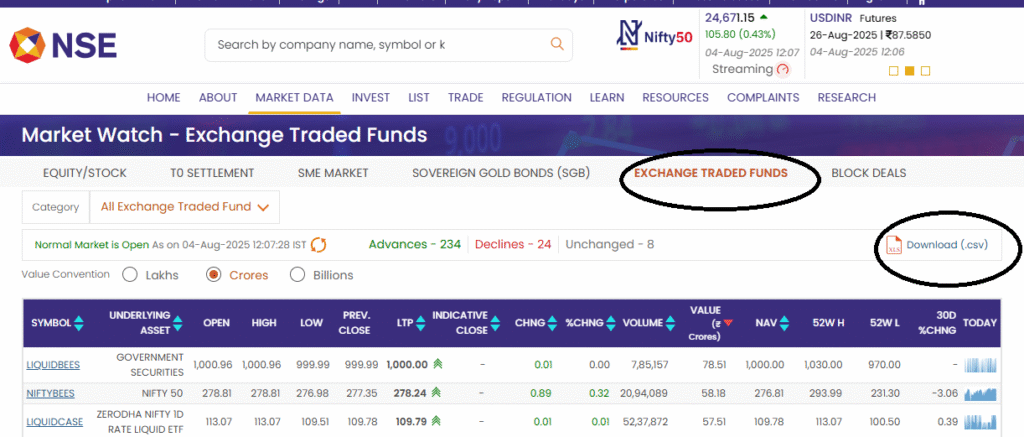

How do we find such ETFs?

- Go to the NSE website

- Download the entire ETF list in Excel format (There are usually 264–267 ETFs listed)

- From that list, filter out only equity ETFs

- Among those, look for high-volume ETFs (for example, underline or highlight just one from each category for easy tracking)

- Now you will have a refined list of around 57-66 equity ETFs

For each of these:

- Compare the CMP with the 52-week low

- Calculate the percentage difference

- If the difference is under 10%, then that ETF may be considered close to the bottom and worth analyzing for potential buying

ETF Buying Strategy (Near 52-Week Low)

Buying Zone Check — Nifty Top 10 Equal Weight Index

CMP (Current Market Price): ₹96.00

52-Week Low: ₹86.50

Difference = ₹96.00 – ₹86.50 = ₹9.50

% Above 52W Low = (₹9.50 / ₹86.50) × 100 = ~10.98%

Conclusion:

This index is slightly above the 10% threshold, so it’s not strictly in the buy zone — but very close. You may:

- Wait for dip near ₹90–91

OR - Use SIP / staggered buying strategy if bullish on long-term prospects.

DSP Nifty Top 10 Equal Weight ETF is a smart way to invest in India’s top 10 companies with equal weightage. It offers diversification and balance without over-dependence on any single stock. With low cost, easy access, and long-term growth potential, it stands out as a strong option. If you’re looking for a simple yet powerful investment – this ETF is worth exploring.

Click to watch – understand in minutes!

How to Calculate Target Price of DSP Nifty Top 10 Equal Weight ETF (2025–2030)?

This ETF mirrors the Nifty Top 10 Equal Weight Index, so its future price depends mainly on the performance of the 10 top Nifty stocks, market conditions, and earnings growth.

Step-by-Step Target Estimation:

1. Understand What It Tracks:

This ETF equally invests in 10 biggest Nifty stocks (like Reliance, HDFC Bank, Infosys, etc.)—each stock gets 10% weight, not based on market cap.

2. Check Index Past Performance:

Example:

- 5-year CAGR of the Nifty Top 10 Equal Weight Index ≈ 13-15%

- So, we use this growth rate to forecast future value.

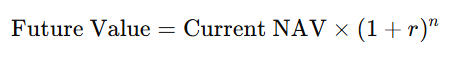

3. Apply CAGR Formula:

To estimate price in 2025 or 2030, use: Future Value=Current NAV×(1+r)n\text{Future Value} = \text{Current NAV} \times (1 + r)^nFuture Value=Current NAV×(1+r)

Where:

r= CAGR (say, 13% = 0.13)n= Number of years (2025 = 1 year; 2030 = 6 years)Current NAV= Let’s say ₹120 (as example)

Target 2025 =

₹120 × (1 + 0.13)^1 ≈ ₹135.60

Target 2030 =

₹120 × (1 + 0.13)^6 ≈ ₹240.91

(Use actual NAV at your time of investment for real results.)

Estimated Target Table (Example):

| Year | Target Price (Est.) |

|---|---|

| 2025 | ₹135 – ₹138 |

| 2026 | ₹152 – ₹155 |

| 2027 | ₹172 – ₹176 |

| 2028 | ₹195 – ₹200 |

| 2029 | ₹220 – ₹227 |

| 2030 | ₹240 – ₹245 |

What is DSP Nifty Top 10 Equal Weight ETF?

It is an Exchange Traded Fund that invests equally in the top 10 Nifty 50 companies, regardless of their market size.

How is it different from a regular Nifty 50 ETF?

Regular Nifty 50 ETFs are market-cap weighted (big companies get more weight), but this ETF gives equal weight (10%) to each of the top 10 stocks.

Is this ETF actively managed?

No, it is passively managed. It simply tracks the Nifty Top 10 Equal Weight Index.

Who should invest in this ETF?

Investors who want exposure to India’s top 10 companies without concentration risk can consider this ETF.

What are the top holdings in this ETF?

It includes 10 leading Nifty 50 stocks like Reliance, HDFC Bank, Infosys, ICICI Bank, TCS, etc., with equal allocation.

How often is the portfolio rebalanced?

The index is usually rebalanced semi-annually to maintain equal weight in all 10 stocks.

On which platforms is this ETF traded?

It is traded on both NSE and BSE, like any other listed stock.

How can I invest in this ETF?

You can invest through your demat account using any brokerage platform (like Zerodha, Groww, etc.).

To explore the DSP Nifty Top 10 Equal Weight ETF in detail, visit the official DSP Mutual Fund website directly.

Read More

CarTrade Tech Ltd Share Price Target 2025, 2026, 2030, 2040, 2050

Jio Financial Services Share Price Target 2025

Disclaimer:

All content shared by STOCK OVERVIEW is intended solely for educational and informational purposes. We do not provide investment advice, stock recommendations, or any kind of financial advisory services. Viewers and readers are strongly advised to consult a SEBI-registered financial advisor before making any investment or trading decisions.

The information presented is designed to enhance market understanding and awareness. STOCK OVERVIEW shall not be held liable for any financial losses or gains arising from the use of this content.

The securities and examples mentioned are strictly for illustration purposes and should not be construed as a solicitation or recommendation to buy or sell. This content is created with the sole objective of educating and guiding individuals in their financial learning journey.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Contents

- 1 DSP Nifty Top 10 Equal Weight ETF – Market Capitalization –

- 2 DSP Nifty Top 10 Equal Weight ETF – Weightage

- 3 DSP Nifty Top 10 Equal Weight ETF – How is an Equal Weight ETF different?

- 4 What is DSP Nifty Top 10 Equal Weight ETF?

- 5 Fund Summary DSP Nifty Top 10 Equal Weight ETF

- 6 DSP Nifty Top 10 Equal Weight ETF- Let’s understand the buying method now

- 7 How to Calculate Target Price of DSP Nifty Top 10 Equal Weight ETF (2025–2030)?

- 7.1 Step-by-Step Target Estimation:

- 7.2 Estimated Target Table (Example):

- 7.3 What is DSP Nifty Top 10 Equal Weight ETF?

- 7.4 How is it different from a regular Nifty 50 ETF?

- 7.5 Is this ETF actively managed?

- 7.6 Who should invest in this ETF?

- 7.7 What are the top holdings in this ETF?

- 7.8 How often is the portfolio rebalanced?

- 7.9 On which platforms is this ETF traded?

- 7.10 How can I invest in this ETF?