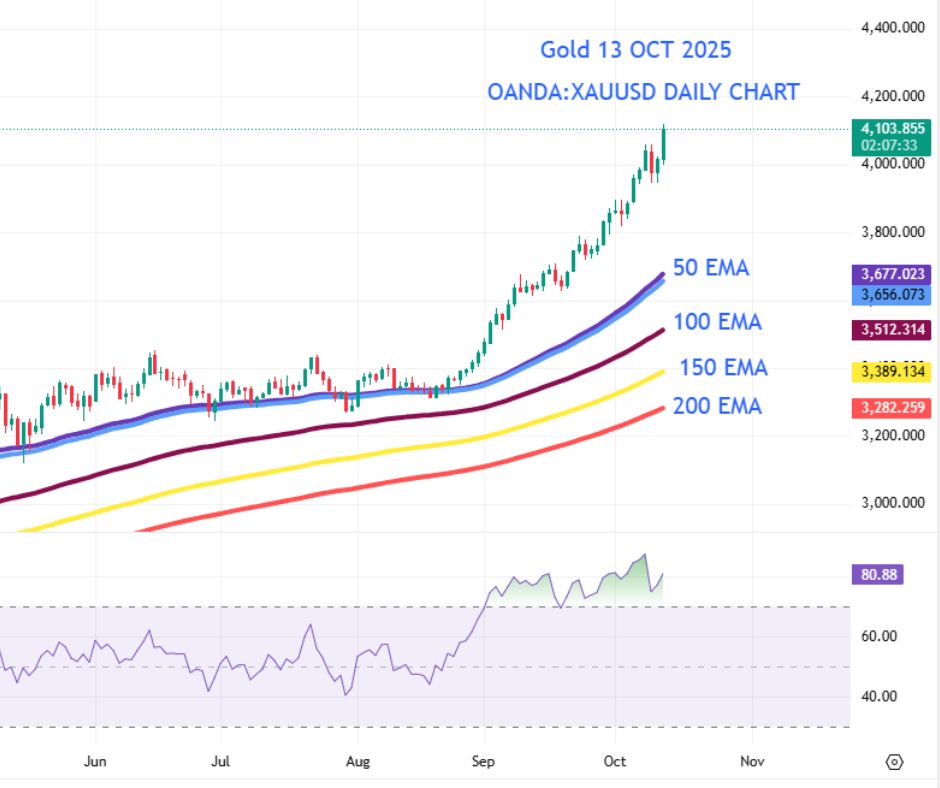

Gold has once again captured the spotlight as prices shoot past the $4100 mark! Investors are eyeing new highs as bullish momentum strengthens across all timeframes.

Gold (XAUUSD) is trading at $4,103.71 per ounce.

Gold Market Analysis – 13 October 2025

Price is making new highs above $4,100, showing strong bullish momentum.

Short-term trend is strongly bullish, price is well above this level.

100 EMA (3,512.31) – Confirms medium-term uptrend.

150 EMA (3,389.13) & 200 EMA (3,282.26) – Long-term trend also bullish, showing strong support below current levels.

Observation: All EMAs are sloping upwards with price trading above all EMAs, indicating a strong bullish trend.

Momentum (RSI)

RSI = 80.88 – Currently in overbought zone (>70).

Interpretation: Gold is in a strong buying momentum phase. Short-term pullbacks may occur, but overall trend remains upward.

Support & Resistance Levels

Immediate Support: $4,000 (psychological level)

Strong Support: 50 EMA at $3,677

Immediate Resistance: $4,150–$4,200 (all-time highs zone)

Trend Summary

Gold has entered a powerful bullish phase, breaking previous resistance levels.

Buying momentum is strong, but RSI indicates a slight caution for potential short-term corrections.

Investors looking for short-term entry should watch for pullbacks near support levels.

Long-term investors can consider holding positions as overall trend remains strongly bullish.

Gold is trending upward sharply – Bullish momentum is intact.

RSI shows overbought conditions, short-term corrections possible.

EMAs confirm strong support at 50 EMA ($3,677) and 100 EMA ($3,512).

Next major resistance is near $4,150–$4,200.

Gold continues its unstoppable rally, maintaining strong bullish momentum above all key EMAs. Though short-term corrections may occur, the long-term outlook remains firmly positive. Traders should look for dips near support, while long-term investors can confidently hold their positions.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.