Market News-IRFC Share Price Target Analysis

IRFC stock rebounds from lows! CMP ₹146.41, eyes ₹166 next. Railway infra boost powers rally!

IRFC shines bright as railway infra push fuels investor confidence!

Strong budget support powers IRFC’s growth momentum!

It is a government-owned NBFC (Non-Banking Financial Company) that provides financial support to Indian Railways by funding its infrastructure and asset development needs.

In this article, we will clearly and thoroughly explore the latest news, fundamentals, and technical analysis of IRFC. Let’s understand what’s driving the stock and where it may be headed next.

IRFC shares rose 3.17% on June 4, closing at ₹145 after hitting an intraday high of ₹149. The rally was driven by fresh government contracts and infrastructure developments in the railway sector.

Current Market Price-146 (06-06-2025)

Shares of IRCON, RVNL, RailTel, and RITES jumped sharply—some up to 12%—driven by new projects and contracts. This positive momentum also benefits IRFC, as it finances railway infrastructure and gains from sector expansion.

| Company | Role | Latest Price | Key Recent Drivers |

|---|---|---|---|

| IRCON | EPC infrastructure construction | ₹218.52 | Big EPC contracts, 12% surge |

| RVNL | Railway network development | ₹428.65 | New railway contracts, 6% rally |

| RailTel | Digital & fibre broadband on rail | ₹444.15 | Strong Q4, digital demand, 10%+ jump |

| RITES | Technical consultancy | ₹300.15 | Q4 profit rise, order inflow, ~6% gain |

On June 4, investor confidence in the railway sector surged following the government’s record ₹2.62 lakh crore allocation in the 2025 budget. This move is expected to strengthen the railway industry significantly.

Under the PM Gati Shakti scheme, a ₹3,399 crore railway project has been approved in Madhya Pradesh and Maharashtra. It spans 1,176 kilometers and is expected to be completed by 2029-30. The project will benefit 784 villages and 1.974 million people, while improving freight and passenger transportation.

IRFC, as the main financer of railway infrastructure, plays a central role in the sector’s growth. Included in Nifty Next 50 and Nifty 100, the company shows strong fundamentals, reinforcing its importance in railway development.

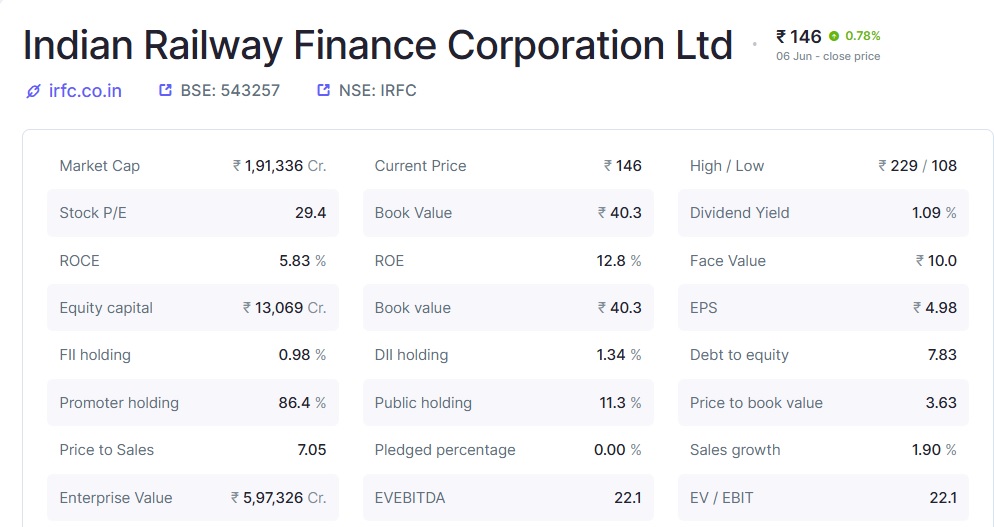

Financial Highlights (as of March 2025):

(Data Source: Screener.in)

Fundamental Analysis

Strong Points (Positives)

| Metric | Value | Remarks |

|---|---|---|

| Promoter Holding | 86.4% | Very high – strong government backing |

| EPS | ₹4.98 | Reasonable – shows stable earnings |

| ROE | 12.8% | Decent – above 12% is considered healthy |

| Dividend Yield | 1.09% | Moderate – provides income to investors |

| Book Value | ₹40.3 | Solid – indicates net worth per share |

| FII + DII Holding | 2.3% combined | Low but present – scope for growth |

Weak Points (Concerns)

| Metric | Value | Remarks |

|---|---|---|

| ROCE | 5.83% | Below average – indicates weak capital efficiency |

| Debt to Equity Ratio | 7.83 | 🚨 Very high – common for NBFCs, but risky |

| Sales Growth | 1.9% | Very slow – indicates sluggish expansion |

| Price to Sales Ratio | 7.05 | Expensive – ideally should be below 3 |

| Price to Book Ratio | 3.63 | Slightly overvalued – under 3 is preferred |

| Public Holding | 11.3% | Low – implies less liquidity in public markets |

IRFC is a safe, government-backed NBFC with stable earnings and consistent dividends. It performs well on parameters like ROE, EPS, and promoter holding. However, it carries very high debt, slow growth, and premium valuation.

Investors should do their due diligence or consult a financial advisor, especially considering the low ROCE and high debt levels.

IRFC -MONTHLY CHART & CHECKLIST

| HIGHER TIME FRAME | |

| MONTHLY -MACD | DOWNWARD |

| MONTHLY -RSI | 58.43 |

IRFC -WEEKLY CHART & CHECKLIST

| HIGHER TIME FRAME | |

| WEEKLY -MACD | UPWARD |

| WEEKLY -RSI | 55.38 |

IRFC -DAILY CHART & CHECKLIST

| CURRENT-ENTRY- TIME FRAME | |

| DAILY -MACD | UPWARD |

| DAILY-RSI | 66 |

| DAILY -STOCHASTIC | 90 |

Chart Breakdown (Daily Timeframe)

Candlestick Pattern

- Recent candles are bullish with higher highs and higher lows.

- No strong reversal candle yet near resistance, indicating momentum continues.

Volume Pattern

- Rising volume on green candles = positive buyer interest.

- Suggests accumulation phase is ongoing.

Moving Averages (WMA)

- Price is above both 50-day and 200-day WMAs, indicating a bullish trend.

- 50-WMA is approaching 200-WMA but crossover hasn’t happened yet (watch closely).

Fibonacci Retracement

- The 155–168 zone likely aligns with the 61.8% retracement level, making it a strong resistance zone.

Divergence

- No visible bearish or bullish divergence between RSI and price at the moment.

Key Technical Levels

| Type | Level | Remarks |

|---|---|---|

| Immediate Resistance | 155 | Near-term hurdle |

| Major Resistance | 168.46 | Strong historical barrier |

| Immediate Support (SL) | 137 | Closest support for risk control |

| Major Support | 110.97 | Long-term base zone |

| Stoploss (for fresh buy) | 135–137 | Under support zone |

| Target (short term) | 155 / 168 | As per resistance levels |

| Risk to Reward | 1:2 approx | Entry near 137; SL: 135; Target: 155 |

Summary:

- Trend: Bullish

- Momentum: Strong

- Volume: Rising on upmoves

- Strategy: Buy on dips near 137 with SL below 135 for targets of 155 & 168.

Expert view and target outlook for IRFC from 2025 to 2030:

- Strong Government Backing: IRFC is the financing arm of Indian Railways and enjoys solid government support, which keeps its credit risk very low.

- Infrastructure Growth Driver: With rapid expansion in India’s infrastructure and railway projects, IRFC is likely to see steady demand for funding.

- Stable Returns: IRFC issues fixed-income securities (bonds), providing stable interest income and making it less volatile than typical stocks.

- Long-term Price Target: Experts suggest IRFC could reach around ₹180-₹200 by 2025 and potentially ₹250-₹300 by 2030, depending on economic growth and interest rate trends.

- Risk Factors: Rising interest rates or economic slowdowns could pose some pressure, but the overall outlook remains positive.

If you’re looking for a long-term, relatively safe investment, IRFC appears to be a good option for 2025–2030.

Why is IRFC considered a strong investment in FY25?

Because it showed solid financial growth, strong fundamentals, and consistent government-backed support.

What are the key financial highlights of IRFC in FY25?

IRFC posted strong numbers in FY25 with ₹27,152 Cr revenue, ₹6,521 Cr profit, 49.98% ROCE, and higher dividend payout.

Conclusion: IRFC Share Price Target & Long-Term Outlook (2025–2030)

IRFC delivered a strong performance in FY25 across all key indicators. The company reported growth in both revenue and profit, reflecting operational strength. Cash flow from operations remained healthy, reinforcing its financial stability. Increases in EPS, dividend, and book value per share indicate rising shareholder value. With ROCE close to 50% and a solid ROE, IRFC’s efficiency remains impressive. Total liabilities are under control, and net cash flow is positive. As a fundamentally strong and cash-rich PSU, it is emerging as a reliable long-term investment option. IRFC adds both stability and growth potential to any investor’s portfolio.

Read More

LIC Share Price target Analysis 2025: Should You Invest Now or Wait?

Yes Bank and SMBC Deal 2025: Profits, Stake and Future Plans

Disclaimer:

All content shared by STOCK OVERVIEW is intended solely for educational and informational purposes. We do not provide investment advice, stock recommendations, or any kind of financial advisory services. Viewers and readers are strongly advised to consult a SEBI-registered financial advisor before making any investment or trading decisions.

The information presented is designed to enhance market understanding and awareness. STOCK OVERVIEW shall not be held liable for any financial losses or gains arising from the use of this content.

The securities and examples mentioned are strictly for illustration purposes and should not be construed as a solicitation or recommendation to buy or sell. This content is created with the sole objective of educating and guiding individuals in their financial learning journey.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Very Informative

Thanks

Deep information. Nice

Thanks

Very informative post about Irfc.

Very informative post about Irfc.

Thanks