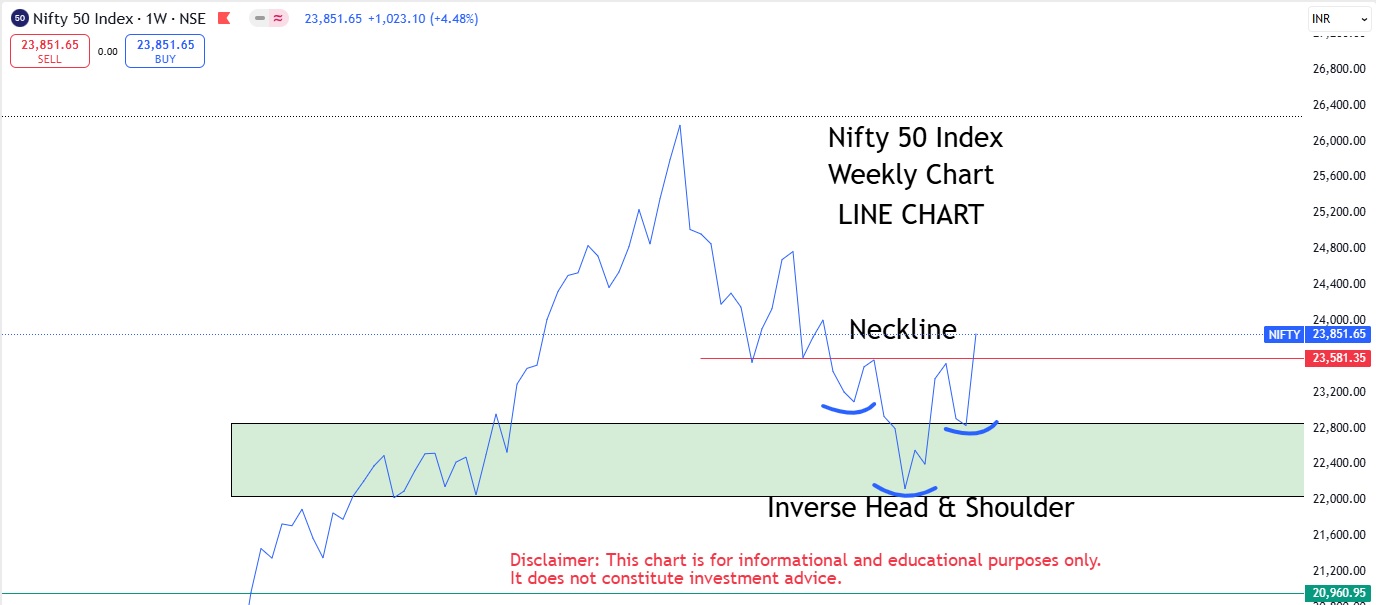

Get the latest Nifty 50 Weekly Outlook – April 17, 2025. Key levels, rare bullish candlestick pattern & market outlook decoded in easy language.

Nifty 50 Weekly Outlook- Important Updates April 17, 2025

Weekly Data Snapshot :

| Parameter | Value |

|---|---|

| Current Closing | 23851.65 |

| Previous Closing | 22828.55 |

| Weekly Change (Price) | 1023.10 Points |

| Weekly Change (%) | 4.48% |

| Support Levels | 21,750 – 20,976 |

| Resistance Levels | 24,226 – 24,857 |

| Pattern Detected | Inverse Head & Shoulder |

| Chart | Line Chart |

| Candlestick Pattern | Bullish Green Candle |

| Volume | Sufficient Volume |

| Trend Indicator MACD | Bullish Crossover Weekly |

| Entry Indicator (RSI) | 62.57 (Bullish) Daily |

| Entry Indicator(Stochastic) | 99.03(Overbought) Daily |

| Divergence | Yes |

| Outlook | Positive above 22,270 |

| Downtrend’s Lowest Level | 21,743.65 (07.04.25) |

How to Calculate Price and Percentage Change

| Current Weekly Closing = ₹23,851.65 |

| Previous Weekly Closing = ₹22,828.55 |

| Price Change: |

| = Current Closing − Previous Closing |

| = ₹23,851.65 − ₹22,828.55 |

| = ₹1,023.10 |

| Percentage Change: |

| = (Price Change ÷ Previous Closing) × 100 |

| = (1,023.10 ÷ 22,828.55) × 100 |

| = 4.48% |

| So, the market increased by ₹1,023.10 or 4.48% this week. |

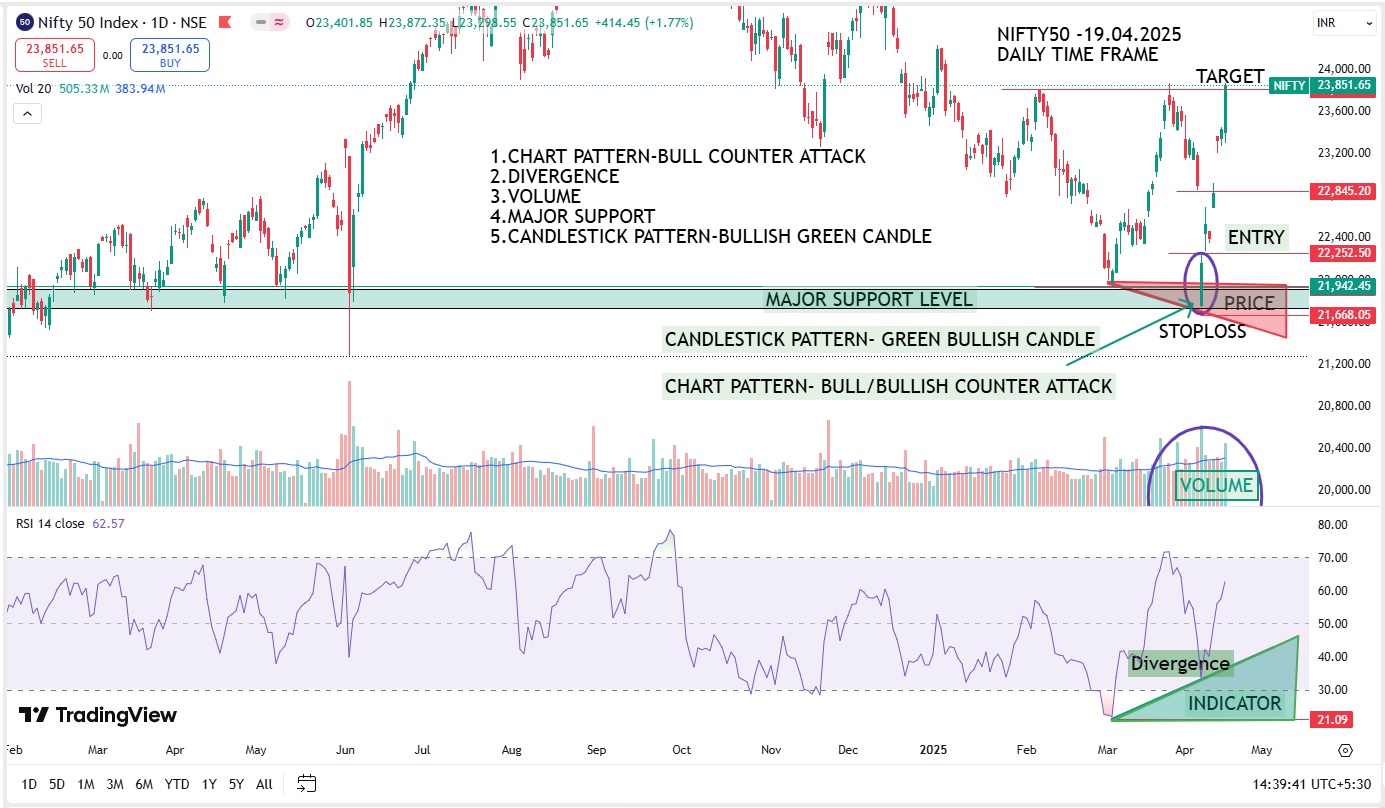

Bullish/Bull Counter Attack Line

Key Characteristics of This Pattern:

| Point | Description |

|---|---|

| Pattern Type | Reversal Pattern (trend change signal) |

| Frequency | Very Rare |

| Requirement | Must occur after a minor downtrend |

| Chart Type | Candlestick Chart |

| Psychology | Sellers get trapped after gap down |

| Entry Point | After the bullish candle closes |

| Stop Loss | Low of the green candle |

| Target | Capture swing move within 5–6 candles |

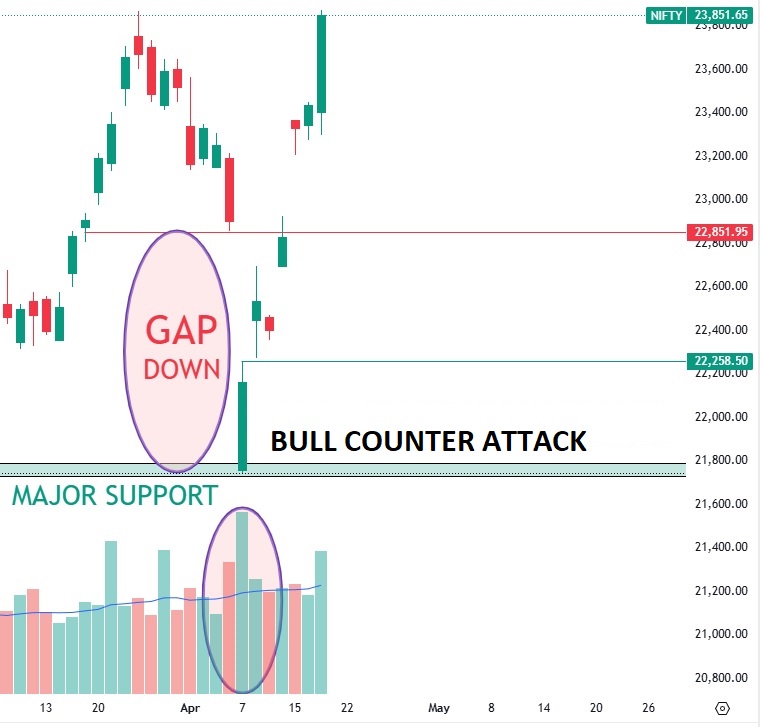

Bull/Bullish Counter Attack

A bullish counter attack is a reversal candlestick pattern that appears during a downtrend. After a gap-down, the bulls make a strong comeback and push the price closer to the previous day’s close, indicating the strength of the buyers

| Rare but Powerful Pattern: |

| The Bullish Counter Attack is a rare (Big Time Frame) candlestick pattern. |

| It indicates a potential strong change in market direction. |

| Where It’s Seen Recently: |

| This pattern has been recently spotted in Nifty, Bank Nifty, and other stocks. |

| How the Pattern Forms: |

| First, there should be a minor downtrend (down swing). |

| Then one day, the price opens with a big gap down. |

| During the same day, the price recovers strongly. |

| The candle closes near or at the same level as the previous day’s close. |

| Result: |

| A big green candle is formed, showing that bulls made a strong comeback. |

Major Support

When a price touches a level 3-4 times and bounces back upwards each time, this level becomes a strong support. If the price stays at the same place for a long time and the trading volume is also good there, then this support becomes even stronger.

or

When consolidation, resistance, and support all happen at the same level, it becomes a strong price zone and may act as a major support or resistance.

Bullish Divergence

When it happens:

- Price: Making a Lower Low

- Indicator (like RSI/MACD): Making a Higher Low

This indicates that the downtrend is weakening, and the market may move upwards soon.

Divergence is formed when price action and indicators show conflicting signals.

Why is Volume important in technical analysis?

Because volume confirms trends.

Rising price + high volume = Strong move

Rising price + low volume = Weak or unsustainable move

Frequently Asked Questions (FAQs) on Technical Analysis

What is Major Support?

Major Support is a price level where the market tends to stop falling and starts rising. It’s often tested multiple times and holds strong due to buyer interest.

Can a Level be called Major Support if both Resistance and Support occur at the same price zone?

Yes. If a price level acted as resistance earlier and now acts as support — both in the same price zone — it is considered a Major Support Level.

What does it mean when Price says one thing and Indicator says another?

This is a divergence — it shows that the momentum behind the trend is weakening. Traders often prepare for potential reversal at such points.

What should be the entry and stop-loss when a Bullish Counter Attack Line pattern forms?

Entry: At the close of the bullish candle.

Stop Loss: Low of the same bullish candle.

Target: Look for a 5–6 candle swing move.

Why do sellers get trapped during the Bullish Counter Attack Line?

Sellers enter at the gap-down open, expecting the fall to continue. But when strong recovery happens, their positions go into loss, and they are forced to exit. This adds to the buying pressure.

What is Volume in trading?

Volume refers to the number of shares or contracts traded during a specific time period. It shows the strength behind a price movement.

What does high volume mean?

High volume means strong market interest — either from buyers or sellers. It often leads to big price moves or breakouts.

Nifty 50 Weekly Outlook – Important Update April 19, 2025-conclusion

Traders should focus on price action, volume spikes, and candlestick signals near these levels. Use proper stop-loss, follow your strategy with discipline, and do not chase the market emotionally. Stay updated and trade with awareness, as the market can turn anytime.

Read More

Nifty 50 Share Price Target 2025 |Crash or Recovery?

Silver Share Price Target 2025: Analysis and outlook

Gold Price Forecast 2025: अब सोने में निवेश करें या इंतजार ?

Crude Oil Share Price Target 2025| Analysis & Outlook

NSE Website update 2025: जानें Best फीचर्स और बदलाव

Intraday to Delivery: Avoid This Big Mistake!

ETFs Share Price Target 2025 – Buy Low, Sell High Strategy

Why Are ETFs Best for Swing Trading?

Are ETFs like mutual funds? free education 2025

ETF से Risk-Free कमाई के Best Secrets

Disclaimer: This blog is for educational purposes only and does not constitute financial advice. Please consult your financial advisor before making any trading or investment decisions. The author is not responsible for any profit or loss arising from the use of this content.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Contents

- 1 Nifty 50 Weekly Outlook- Important Updates April 17, 2025

- 2 How to Calculate Price and Percentage Change

- 3 Bullish/Bull Counter Attack Line

- 4 Bull/Bullish Counter Attack

- 5 Major Support

- 6 Bullish Divergence

- 7 Why is Volume important in technical analysis?

- 8 Frequently Asked Questions (FAQs) on Technical Analysis

- 8.0.1 What is Major Support?

- 8.0.2 Can a Level be called Major Support if both Resistance and Support occur at the same price zone?

- 8.0.3 What does it mean when Price says one thing and Indicator says another?

- 8.0.4 What should be the entry and stop-loss when a Bullish Counter Attack Line pattern forms?

- 8.0.5 Why do sellers get trapped during the Bullish Counter Attack Line?

- 8.0.6 What is Volume in trading?

- 8.0.7 What does high volume mean?