Do you blindly follow stock tips from TV or Telegram channels? This case is a serious wake-up call for every retail investor.

SEBI Busts Sanjiv Bhasin’s ₹11 Cr Pump & Dump Scam – exposing a dangerous trap.

Let’s Decode: Sanjiv Bhasin SEBI action pump dump scam explained

Short Summary:

Date: 17 June 2025

Name: Sanjiv Bhasin

Scam Amount: ₹11.37 Crores

Action by SEBI: Market ban + Funds impounded

Reason: Pump & Dump using media and social tips

Do you rely on TV tips, Telegram channels, or social media posts to decide your trades in the stock market? Think twice. A recent case by SEBI proves how blind trust in “experts” can lead to disaster.

What Happened?

On 17 June 2025, SEBI (Securities and Exchange Board of India) issued an interim order banning Sanjiv Bhasin and 11 others from accessing the securities market. They were found guilty of executing a “Pump & Dump” scam worth ₹11.37 crore.

Sanjiv Bhasin, a popular figure seen on stock market TV shows and social platforms, allegedly used his public image to give buy calls on specific stocks while secretly selling his own holdings in those same stocks.

SEBI’s 149-page order contains evidence such as:

- WhatsApp chats

- Call recordings

- Trade logs showing front-running

What is Pump & Dump?

Pump and Dump is a market manipulation technique where the scammer:

- Buys a stock at a low price

- Promotes it heavily to raise the price artificially (“Pump”)

- Sells the stock at the peak to exit (“Dump”)

The result? Retail investors, who buy late, suffer huge losses when the price crashes.

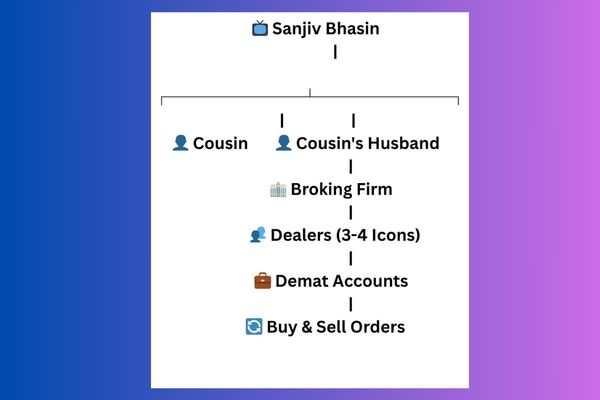

How Did the Scam Work?

- Bhasin and his associates would purchase stocks beforehand.

- He would then go live on television and Telegram channels to recommend those same stocks.

- Once retail traders jumped in and prices surged, they sold their holdings for profit.

This activity was repeated multiple times over several months, with patterns clearly visible in SEBI’s findings.

Why It Matters for Retail Investors

This case is a wake-up call. No matter how confident or credible someone appears, following stock tips blindly can lead to serious financial losses.

SEBI’s strict action shows that regulations are in place to protect retail investors, but awareness and education are equally important.

Twist in the Tale: From Stocks to Astrology

Interestingly, after scrutiny increased, Sanjiv Bhasin shifted his focus from financial advice to astrology. He began sharing cosmic updates like “Mars enters Leo” instead of stock tips. Coincidence? You decide.

Vedio-Sanjiv Bhasin SEBI ACTION pump dump scam

Lessons You Must Learn

Protect yourself by:

- Avoiding impulsive decisions based on social media or TV

- Doing your own research or consulting licensed advisors

- Learning basic stock market principles

Was Sanjiv Bhasin a SEBI-registered advisor?

No – he provided stock recommendations as a contractual consultant via TV and Telegram, but did not hold a SEBI Investment Adviser registration, which requires disclosure and trading restrictions.

Conclusion

Profit in the stock market requires knowledge, discipline, and research. Scams like these serve as a reminder: Don’t chase shortcuts. Learn before you earn.

Disclaimer:

All content shared by STOCK OVERVIEW is purely for educational and informational purposes only. We do not provide any investment advice or stock recommendations. Please consult a SEBI-registered financial advisor before making any trading or investment decisions. This content is created solely to help and guide you with market awareness. STOCK OVERVIEW will not be held responsible for any financial gains or losses arising from the use of this information.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.