What Happened in the Market Today? Catch the complete market wrap for 04 Jun 2025! Sensex, Nifty, sector indices, FII-DII activity, commodities, global trends & crypto – all decoded in one place.

Share Market wrap 04 June 2025:

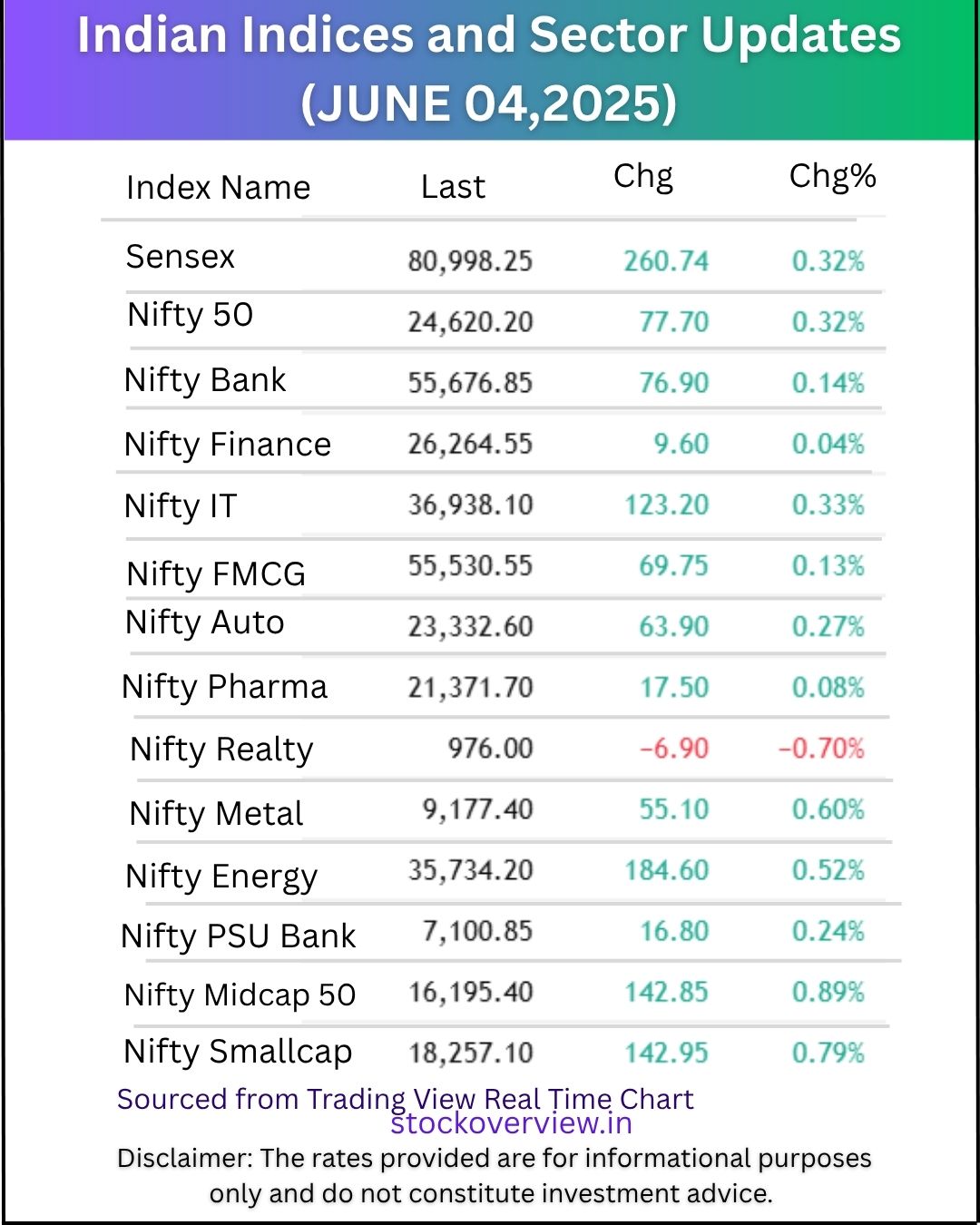

Indices & Sector Performance Summary

Sensex closed at 80,998.25, up by 260.74 points (0.32%), reflecting broad market positivity.

Nifty 50 followed suit, gaining 77.70 points to settle at 24,620.20 (0.32% rise).

Nifty Bank rose slightly by 76.90 points (0.14%), indicating marginal banking sector gains.

Nifty IT was among the top performers, advancing 123.20 points (0.33%) due to tech strength.

Nifty Midcap 50 and Nifty Smallcap saw sharp gains of 0.89% and 0.79% respectively, suggesting strong interest in broader markets.

Nifty Realty was the only index to close in the red, falling 6.90 points (-0.70%).

Nifty Metal surged 0.60%, supported by sectoral demand and global cues.

Nifty Energy climbed 0.52%, possibly backed by oil & gas performance.

FMCG, Auto, and Pharma sectors posted modest gains, indicating steady consumer and healthcare sentiment.

Overall, most indices ended higher, highlighting bullish sentiment across large, mid, and small-cap segments.

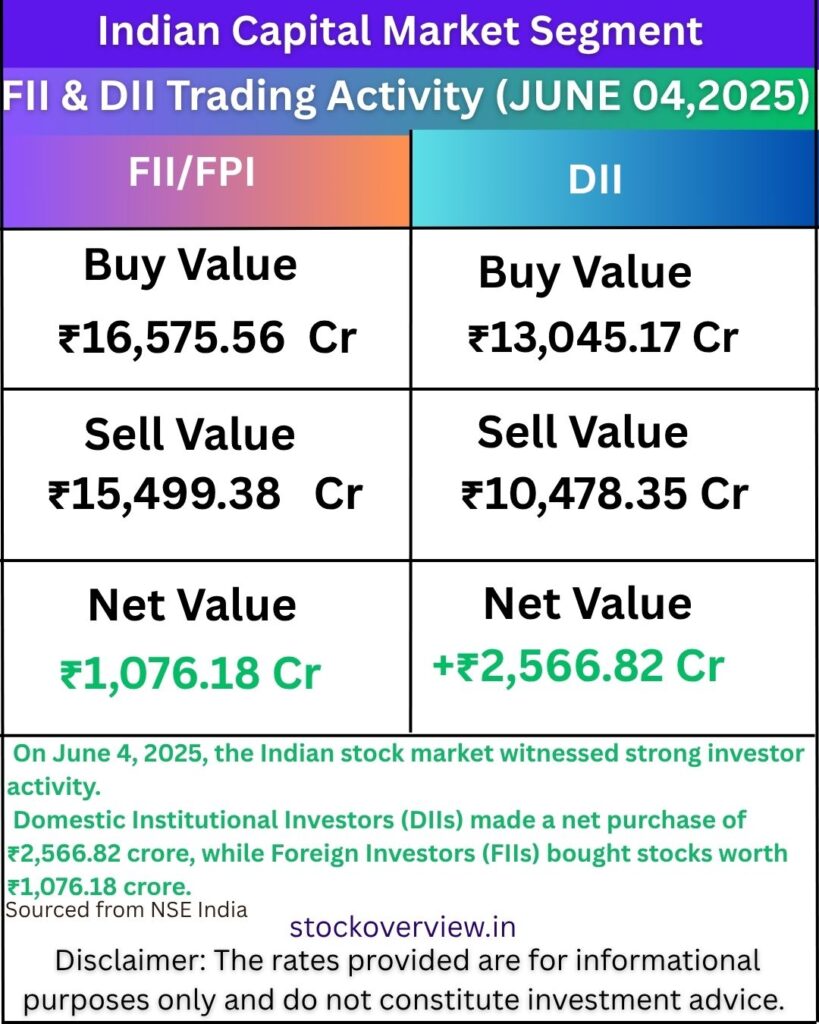

FII & DII Trading Summary 04-June-2025

This report summarizes trading activity in the Indian capital market on June 4, 2025.

It highlights the investment behavior of two key participant groups: Foreign Institutional Investors (FII/FPI) and Domestic Institutional Investors (DII).

FIIs bought equities worth ₹16,575.56 crore and sold equities worth ₹15,499.38 crore.

This resulted in a net inflow of ₹1,076.18 crore from foreign investors.

DIIs recorded a buy value of ₹13,045.17 crore and a sell value of ₹10,478.35 crore.

Consequently, domestic institutions posted a strong net inflow of ₹2,566.82 crore.

The data reflects solid investor confidence in the Indian equity markets.

Domestic investors were notably more aggressive than foreign investors on this trading day.

Such net buying trends can be indicative of market stability and bullish sentiment.

The figures are sourced from NSE India and are intended for informational use only.

CHART-NIFTY-50

CHART-NIFTY BANK

INDIA VIX

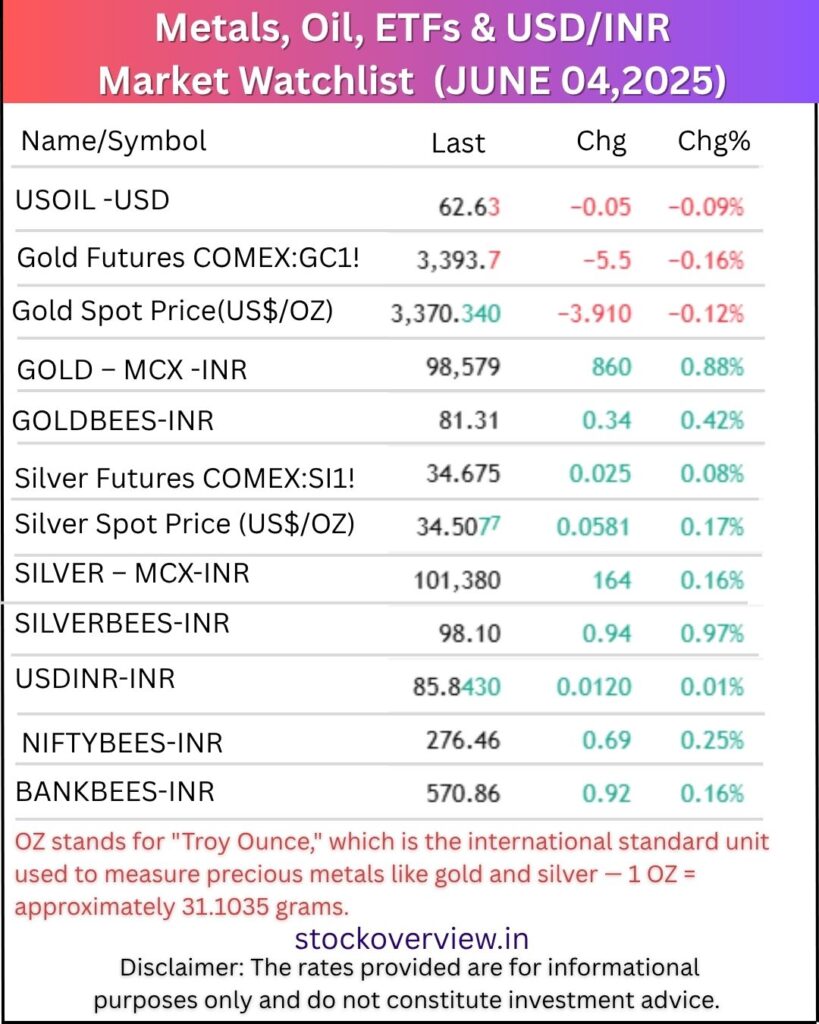

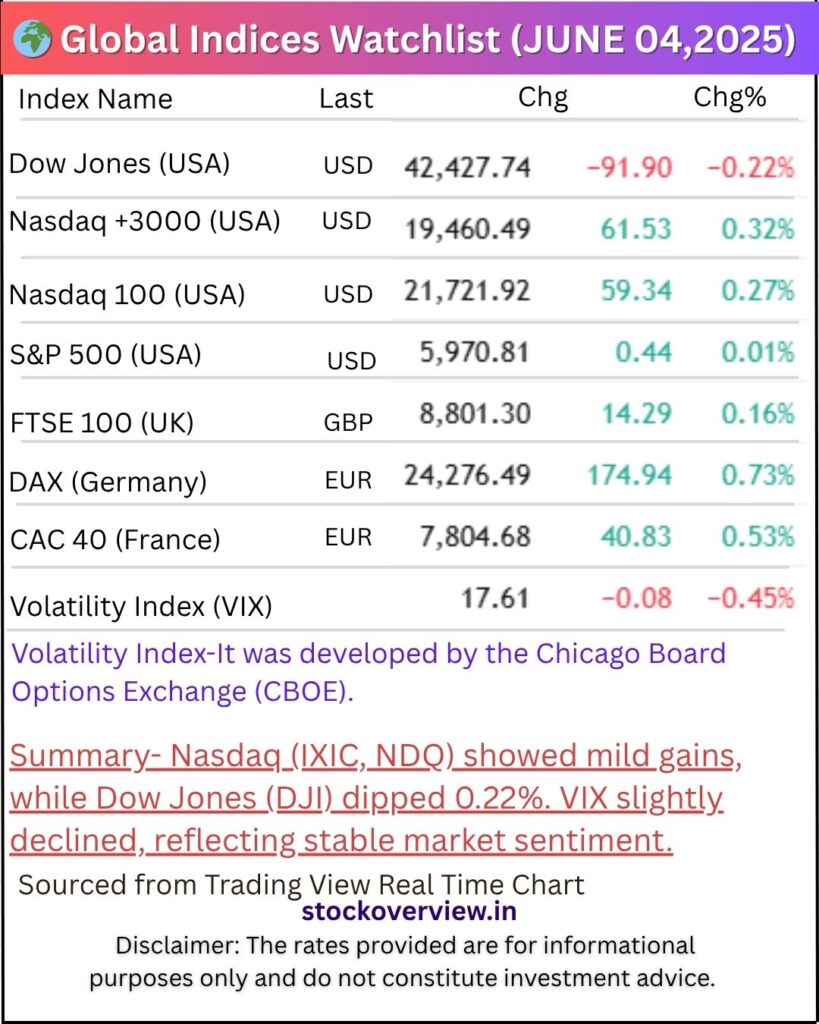

Global Market Summary – 04 June 2025

- Nasdaq 100, Nasdaq Composite, and DAX showed mild gains.

- Dow Jones slipped by 0.22%, reflecting some weakness.

- VIX (Volatility Index) fell slightly, indicating stable sentiment.

- European markets (DAX, CAC 40) remained strong.

- S&P 500 and FTSE 100 stayed almost flat.

Overall, global markets traded mixed with a slight positive bias.

Crypto Market Highlights – June 05, 2025

What is the chart showing?

The current weekly candle is getting smaller and tighter, which means:

Buyers and sellers are both active, but neither side is strong enough to push the price clearly up or down.

This situation is called indecision in the market.

The red arrow points to the candle showing that:

“The market is confused — there is no clear direction.”

Consolidation Phase:

- Bitcoin is trading within a fixed range between $100K and $112K.

- It’s not breaking out upwards or downwards.

- This is a sideways movement — a common phase before a big move.

“Bitcoin is currently moving sideways in a narrow range. The market is waiting for a strong push in either direction. Until a breakout happens, the trend will remain uncertain.”

Major NIFTY Indices – A Simple Explanation

The NIFTY Index encompasses more than just the NIFTY 50, as it includes various sector-specific indices that track different segments of the Indian stock market. Below is a detailed table for your reference:

| Index Name | Sector Focus & Examples |

| NIFTY 50 | Top 50 large-cap companies Reliance, TCS, Infosys |

| BANK NIFTY Nifty Bank | Banking Sector HDFC Bank, ICICI Bank, SBI |

| FINNIFTY Nifty Financial Services | Finance, NBFC, Insurance Bajaj Finance, HDFC, SBI Life |

| NIFTY IT Nifty Information Technology | IT Services TCS, Infosys, Wipro |

| NIFTY FMCG | Consumer Goods HUL, Nestle, Britannia |

| NIFTY AUTO | Automobile Sector Tata Motors, M&M, Bajaj Auto |

| NIFTY PHARMA | Pharmaceuticals Sun Pharma, Cipla, Dr. Reddy’s |

| NIFTY REALTY | Real Estate DLF, Godrej Properties, Oberoi Realty |

| NIFTY METAL | Metals and Mining JSW Steel, Tata Steel, Hindalco |

| NIFTY ENERGY | Energy Sector NTPC, ONGC, Power Grid |

| NIFTY PSU BANK | Government Banks SBI, Bank of Baroda, Canara Bank |

| NIFTY MIDCAP 50 | Top 50 Midcap Companies Tube Investments, Max Financial |

| NIFTY SMALLCAP 100 | Top 100 Smallcap Companies PNB Housing, RBL Bank |

On June 4, 2025, the Indian stock market witnessed a broadly positive session with major indices closing in the green. Sensex and Nifty 50 both gained 0.32%, reflecting strong investor sentiment. Sector-wise, IT, Energy, and Metal led the rally, while Midcap and Smallcap indices outperformed with gains close to 0.9%. However, the Realty sector saw a decline of 0.70%, making it the only laggard. Overall, the market showed resilience with broad-based buying across large and mid-cap segments, supported by strong inflows from both FIIs and DIIs.

What was the global market sentiment on June 04, 2025?

Stable and slightly positive, with tech indices gaining and VIX showing a decline.

Did investors invest in the Indian stock market?

Yes, both FIIs and DIIs were net buyers, showing strong investor confidence.

Read More

LIC Share Price target Analysis 2025: Should You Invest Now or Wait?

Disclaimer:

All content shared by STOCK OVERVIEW is purely for educational and informational purposes only. We do not provide any investment advice or stock recommendations. Please consult a SEBI-registered financial advisor before making any trading or investment decisions. This content is created solely to help and guide you with market awareness. STOCK OVERVIEW will not be held responsible for any financial gains or losses arising from the use of this information.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.