Indian Stock Market Update – 24 June 2025: PSU Banks, Metals & Midcaps Lead the Rally

Let’s decode the key market trends and trading highlights from June 24, 2025.

Share Market wrap 24 June 2025: Sensex 82055 Nifty 25044

MARKET VIEW

Today, the Indian stock market witnessed a broadly positive trend. Sectors like PSU Banks and Metal delivered excellent performance, while the financial and midcap sectors also saw good gains. Most major sectors, with the exception of the IT sector, closed in the green. This reflects investor confidence in the market and continued interest in some key sectors

MAJOR NIFTY INDICES

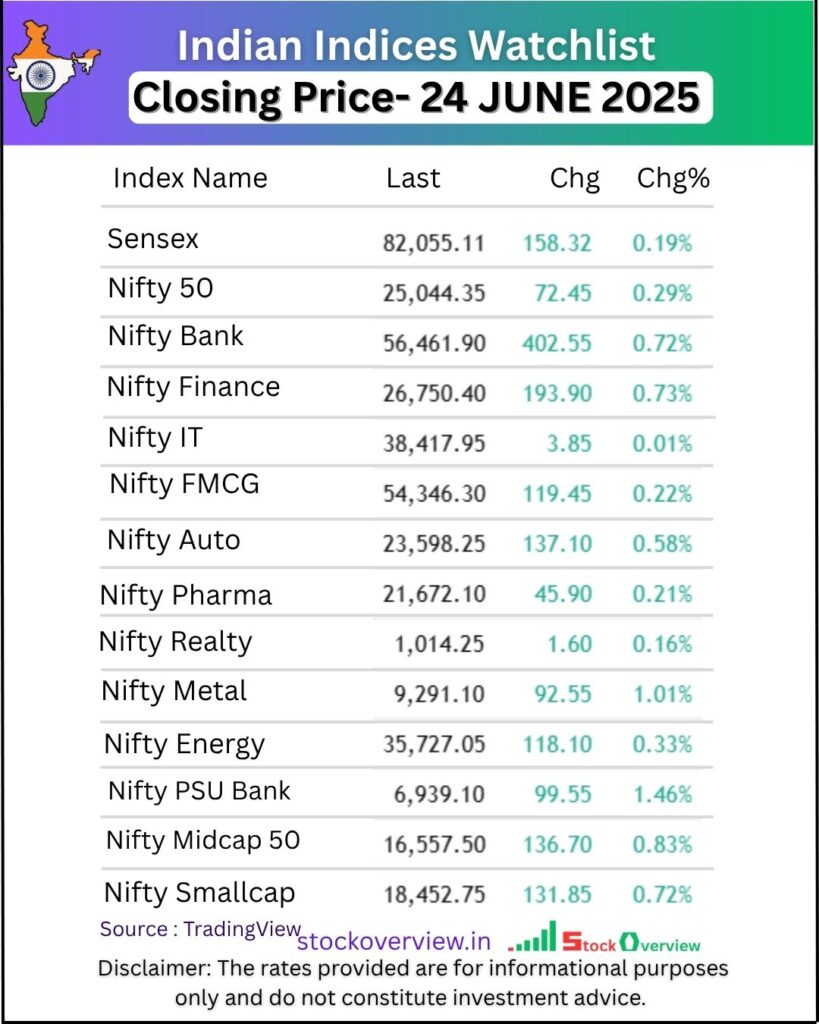

| Index Name | Closing Price | Change (Pts) | Change (%) |

|---|---|---|---|

| Sensex | 82,055.11 | +158.32 | +0.19% |

| Nifty 50 | 25,044.35 | +72.45 | +0.29% |

| Nifty Bank | 56,461.90 | +402.55 | +0.72% |

| Nifty Finance | 26,750.40 | +193.90 | +0.73% |

| Nifty IT | 38,417.95 | +3.85 | +0.01% |

| Nifty FMCG | 54,346.30 | +119.45 | +0.22% |

| Nifty Auto | 23,598.25 | +137.10 | +0.58% |

| Nifty Pharma | 21,672.10 | +45.90 | +0.21% |

| Nifty Realty | 1,014.25 | +1.60 | +0.16% |

| Nifty Metal | 9,291.10 | +92.55 | +1.01% |

| Nifty Energy | 35,727.05 | +118.10 | +0.33% |

| Nifty PSU Bank | 6,939.10 | +99.55 | +1.46% |

| Nifty Midcap 50 | 16,557.50 | +136.70 | +0.83% |

| Nifty Smallcap | 18,452.75 | +131.85 | +0.72% |

Top Gainers

Nifty PSU Bank was the top gainer of the day, rising 1.46%.

Nifty Metal gained 1.01%, reflecting strong industrial interest.

Midcap 50 and Smallcap rose by 0.83% and 0.72% respectively, highlighting broader market strength.

Nifty Bank added 402 points, signaling robust momentum in financials.

Nifty Finance jumped by nearly 194 points.

Underperformers

Nifty IT remained nearly flat, inching up just 3.85 points (0.01%).

Nifty Realty also saw a muted move, rising only 1.60 points (0.16%).

Market Insight:

The performance clearly shows a return of investor confidence, especially in PSU banks, metals, and financial stocks. While IT stocks remained dull, Auto, Pharma, and Energy sectors offered moderate support.

Conclusion

24th June 2025 marked a strong session for the Indian stock market. The momentum in PSU Banks and Metal stocks is a good sign for risk-on sentiment. If this trend continues, Nifty 50 and Sensex may soon test new highs.

CHART- SENSEX

Chart-based Analysis of June 23 Session

CHART-NIFTY50

CHART-NIFTY BANK

INDIA VIX

Which sector was the top performer in the Indian stock market on 24 June 2025?

Nifty PSU Bank was the top performer, gaining 1.46%.

How did the Sensex and Nifty 50 perform today?

Sensex rose 158 points to close at 82,055, while Nifty 50 gained 72 points to end at 25,044.

Major NIFTY Indices – A Simple Explanation

The NIFTY Index encompasses more than just the NIFTY 50, as it includes various sector-specific indices that track different segments of the Indian stock market. Below is a detailed table for your reference:

| Index Name | Sector Focus & Examples |

| NIFTY 50 | Top 50 large-cap companies Reliance, TCS, Infosys |

| BANK NIFTY Nifty Bank | Banking Sector HDFC Bank, ICICI Bank, SBI |

| FINNIFTY Nifty Financial Services | Finance, NBFC, Insurance Bajaj Finance, HDFC, SBI Life |

| NIFTY IT Nifty Information Technology | IT Services TCS, Infosys, Wipro |

| NIFTY FMCG | Consumer Goods HUL, Nestle, Britannia |

| NIFTY AUTO | Automobile Sector Tata Motors, M&M, Bajaj Auto |

| NIFTY PHARMA | Pharmaceuticals Sun Pharma, Cipla, Dr. Reddy’s |

| NIFTY REALTY | Real Estate DLF, Godrej Properties, Oberoi Realty |

| NIFTY METAL | Metals and Mining JSW Steel, Tata Steel, Hindalco |

| NIFTY ENERGY | Energy Sector NTPC, ONGC, Power Grid |

| NIFTY PSU BANK | Government Banks SBI, Bank of Baroda, Canara Bank |

| NIFTY MIDCAP 50 | Top 50 Midcap Companies Tube Investments, Max Financial |

| NIFTY SMALLCAP 100 | Top 100 Smallcap Companies PNB Housing, RBL Bank |

Indian Stock Market

Index (Market Mood / Sentiment)

What is an Index in the Stock Market?

An index is a number that represents the overall performance of a specific group of stocks in the market.

Simple Example:

Just like a thermometer shows your body temperature, a stock market index shows the market’s temperature — whether it’s going up or down.

| Index Name | Tracks How Many Companies? |

| Sensex | Top 30 companies |

| Nifty 50 | Top 50 companies |

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Each company in an index has a weightage (some affect more, some less). When these companies go up or down, the index level also changes.

If Sensex tracks just 30 companies, then how many are actually listed on BSE?

Sensex is an index of the top 30 companies listed on the BSE, designed to represent the overall market trend.

However, there are over 5,000 companies listed on the Bombay Stock Exchange (BSE) in total.

So, Sensex only reflects a small portion of the entire exchange.

Why are indices created?

- To help investors and traders understand the overall market trend

- To see which sectors or companies are performing well

- To plan their strategies — for long-term investing or short-term trading

What does “Tracking” mean?

When we say an index like Nifty or Sensex is “tracking” something, it means:

It tracks the price movements and performance of the companies included in that index.

Understand this clearly:

| Index Name | Exchange Number of companies Tracked |

| Nifty 50 | NSE (National Stock Exchange) 50 |

| Sensex | BSE (Bombay Stock Exchange) 30 |

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

In simple terms:

Nifty 50 tracks only the prices on NSE.

Sensex tracks only the prices on BSE.

Example to understand better:

Reliance Industries is listed on both NSE and BSE.

| On NSE | On BSE |

| Tracked by Nifty 50 | Tracked by Sensex |

So, both indexes are watching only the trades happening on their own exchange.

Companies can be listed on both exchanges (NSE & BSE).

Nifty 50 tracks only NSE prices

Sensex tracks only BSE prices

What is Sensex?

Sensex (or BSE Sensex) is an index that represents the average performance of the top 30 companies listed on the BSE.

This is why many people mistakenly believe that the BSE has only 30 companies — but in reality, Sensex is just an index, not the entire BSE.

BSE (Bombay Stock Exchange) – What is it?

It is a stock exchange — a marketplace where companies list their shares and investors buy or sell them.

Over 6,000 companies are listed on the BSE.

This does not mean that only 30 companies exist — the number 30 refers only to the companies that are part of the BSE Sensex index.

What are NSE (National Stock Exchange) and Nifty 50?

NSE is also a stock exchange, and over 1,900 companies are listed on it.

Nifty 50 is just an index of NSE, which includes the top 50 companies listed on the NSE.

Let’s Clear the Confusion:

| Question | Reality |

| Does BSE have only 30 companies? | No, over 6,000 companies are listed on BSE. |

| Does Sensex include only 30 companies? | Yes, Sensex tracks only 30 companies. |

| Does Nifty 50 have 50 companies? | Yes, Nifty 50 tracks the top 50 companies on NSE. |

| Are these companies listed on both BSE and NSE? | Yes, most of them are listed on both exchanges. |

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Can a single company be listed on both NSE and BSE?

Yes, a single company is often listed on both the NSE and the BSE.

For example, Reliance Industries and others are listed on both exchanges

| Company Name | Listed on NSE & BSE |

| Reliance Industries | Yes |

| TCS | Yes |

Global Stock Market

What is the Dow Jones Industrial Average (DJIA)?

The Dow Jones Industrial Average (DJIA) is one of the oldest and most well-known stock market indexes in the world. It tracks the performance of 30 major U.S. companies from various industries.

Who created it?

It was created in 1896 by Charles Dow and Edward Jones, which is why it’s called the Dow Jones.

Which companies are included?

The index includes 30 large, publicly traded companies that are considered leaders in their sectors.

Examples:

- Apple Inc.

- Microsoft

- Coca-Cola

- Boeing

- McDonald’s

- Goldman Sachs

(Note: The list can change based on company performance and market conditions.)

Unlike some other indexes that are based on market capitalization, the Dow is price-weighted.

This means:

- The stock with a higher price has more influence on the index’s movement.

- If the share prices of most of the 30 companies rise, the Dow goes up.

- If they fall, the Dow goes down.

Why is DJIA important?

- It acts as a barometer of the U.S. economy.

- Global investors use it to judge market sentiment.

- It gives an idea of how big companies in the U.S. are performing.

Example in News:

If you hear on the news:

“The Dow fell 300 points today,”

It means the average price of the 30 major companies’ stocks dropped, and that can reflect market fear or uncertainty.

What Does DJIA Do?

The Dow Jones Industrial Average (DJIA) tracks the stock prices of 30 selected companies and calculates an average index value based on their performance.

So,

DJIA = The price movement of only these 30 companies,

not the entire NYSE or NASDAQ.

NYSE (New York Stock Exchange)

What is it?

- It is the oldest and largest stock exchange in the world.

- Trading used to happen mainly on a physical trading floor, though now it’s also digital.

Key Features:

Many large and established companies are listed here.

Trading style is auction-based and has a human element.

Examples: Boeing, Coca-Cola, Walmart, Goldman Sachs

NASDAQ (National Association of Securities Dealers Automated Quotations)

What is it?

- It is a fully electronic stock exchange.

- Known for listing technology and growth-oriented companies.

Key Features:

- Trading happens entirely via computers.

- Most modern and fast-growing companies are listed here.

- Examples: Apple, Microsoft, Amazon, Google (Alphabet)

NYSE vs NASDAQ – Quick Comparison

| Feature | NYSE | NASDAQ |

|---|---|---|

| Founded | 1792 | 1971 |

| Trading System | Physical + Electronic | Fully Electronic |

| Focus Sectors | Industrial, Finance, Healthcare | Technology, Innovation |

| Notable Companies | ExxonMobil, Coca-Cola | Apple, Meta (Facebook), Tesla |

| Trading Volume | Lower | Higher |

NYSE is known for traditional, blue-chip companies,

while NASDAQ is famous for high-growth tech companies.

In short:

The Dow Jones is like a health check-up report of America’s top companies — and the world watches it closely.

Which Dow Jones Chart Do People Around the World Use?

DJI (TVC)

- Symbol:

DJI - Source: TVC (TradingView Composite)

- Type: Index (not CFD)

Why Choose This?

- This is the most reliable and pure form of the Dow Jones Industrial Average.

- It is widely tracked by news websites, financial TV channels, and professional analysts worldwide.

Dow Jones Industrial Average (DJIA), which tracks stocks listed on both the New York Stock Exchange (NYSE) and NASDAQ, operates during the following hours in Indian Standard Time (IST):

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Regular Trading Hours:

- Opens: 7:30 PM IST

- Closes: 2:00 AM IST

- Duration: From 7:30 PM to 2:00 AM (next day)

Pre-market Trading:

- Time: 1:30 PM to 7:30 PM IST

- Trading happens during this period, but it’s before the main trading session.

After-hours Trading:

- Time: 2:00 AM to 5:30 AM IST

- Trading continues even after the main session ends.

Key Points:

- DJIA is an index, not an independent exchange.

- It represents selected stocks from NYSE and NASDAQ.

- During Daylight Saving Time (DST) in the U.S., trading hours shift one hour earlier in IST.

Who Trades During Pre-market and After-hours Sessions?

Pre-market and after-hours trading is usually done by large and professional investors who have special access and use ECNs (Electronic Communication Networks).

Who Trades During These Hours?

Institutional Investors:

- Mutual Funds

- Hedge Funds

- Pension Funds

- Insurance Companies

These investors manage large sums of money and often have exclusive access to extended trading hours.

Big Banks & Financial Firms:

- JPMorgan Chase

- Goldman Sachs

- Morgan Stanley

- Citigroup

These firms trade on behalf of their clients and themselves.

Professional Traders (via paid platforms):

- Interactive Brokers

- TD Ameritrade

- Charles Schwab

These platforms allow experienced retail traders to access pre-market and after-hours sessions.

Company Insiders:

CEOs, CFOs, or other top executives

They may react to internal reports or announcements before public release (Note: Insider trading is illegal, but reactions to unofficial leaks can occur).

Why Don’t Regular Retail Investors Trade During These Hours?

- Very low trading volume

- Wide spreads (difference between buy and sell prices)

- High volatility

- Charts and data may not fully reflect the market

That’s why the best time for most retail investors to trade is during regular market hours, i.e., 7:30 PM IST to 2:00 AM IST for Dow Jones.

NASDAQ – A Stock Exchange:

NASDAQ stands for National Association of Securities Dealers Automated Quotations.

It is a fully electronic stock exchange in the U.S., just like NSE and BSE in India.

It has over 3,000 listed companies, many of which are big tech giants like Apple, Microsoft, Amazon, etc.

NASDAQ Composite – An Index:

This is an index that tracks the performance of all the stocks listed on the NASDAQ exchange.

On TradingView, you can search it as: NASDAQ:IXIC

NASDAQ-100 – A Major Index:

This index includes the top 100 non-financial companies listed on NASDAQ.

On TradingView, search: NASDAQ:NDX

So why do we hear “NASDAQ” every day?

Because:

- It reflects how U.S. technology and growth companies are performing.

- It influences global markets — including Indian stock market mood.

- Along with Dow Jones and S&P 500, NASDAQ is a key market sentiment indicator.

What is S&P 500?

| Concept | Explanation |

|---|---|

| Name | S&P 500 (Standard & Poor’s 500 Index) |

| Type | Stock Market Index (Benchmark of U.S. Economy) |

| Tracks | Top 500 publicly listed U.S. companies |

| Exchanges | Includes companies from both NYSE and NASDAQ |

| Industries | Covers all major sectors – Tech, Healthcare, Finance, Energy, Retail, etc. |

| Top Companies | Apple, Microsoft, Amazon, Alphabet (Google), JPMorgan, Johnson & Johnson |

| Why it matters | One of the most trusted indicators of U.S. stock market performance |

| Used by | Investors, analysts, mutual funds, index funds, and ETFs |

| Main use | Measures overall market sentiment and economic health of the U.S. |

Summary

- The S&P 500 Index is a key benchmark for tracking the U.S. stock market.

- It reflects how the top 500 companies in America are performing.

- Most investors and analysts consider it the most reliable index in the world.

What is FTSE 100?

| Concept | Explanation |

|---|---|

| Full Name | FTSE 100 Index (pronounced “Footsie 100”) |

| Type | Stock Market Index |

| Country | United Kingdom (UK) |

| Tracks | Top 100 companies listed on the London Stock Exchange (LSE) |

| Launched in | 1984 |

| Maintained by | FTSE Group (a subsidiary of London Stock Exchange Group) |

| Sectors Covered | Financials, Energy, Consumer Goods, Pharmaceuticals, etc. |

| Top Companies | HSBC, BP, Unilever, Shell, AstraZeneca |

| Currency | GBX (Pence Sterling) |

| Why it matters | Reflects the performance of the largest UK-based companies |

| Used by | Global investors to assess the health of the UK stock market |

Summary

- FTSE 100 is the UK’s leading stock market index.

- It tracks the 100 largest companies on the London Stock Exchange by market capitalization.

- It gives investors a snapshot of how the UK economy is performing through its top corporations.

What is Nikkei 225 (Japan)?

Nikkei 225 is the leading stock market index of Japan, just like:

- Sensex for India

- Dow Jones for the USA

- FTSE 100 for the UK

It tracks the top 225 companies listed on the Tokyo Stock Exchange (TSE). These are the largest and most actively traded companies in Japan.

Some well-known companies in Nikkei 225:

- Toyota

- Sony

- Honda

- Mitsubishi

- Panasonic

What does Nikkei 225 show?

It shows the overall performance of the Japanese stock market and gives an idea of Japan’s economic health. When Nikkei goes up, it generally means the market is doing well.

Key Facts:

Point | Details |

|---|---|

| Exchange | Tokyo Stock Exchange (TSE) |

| No. of Companies | 225 |

| Type of Index | Price-weighted index |

| Managed By | Nihon Keizai Shimbun (a Japanese newspaper) |

| Sectors Included | Technology, Automobiles, Industrials, Finance, etc. |

Notes:

- Being a price-weighted index, companies with higher stock prices have more impact on the index.

- It is one of the oldest Asian stock indices, started in 1950.

- International investors follow Nikkei to understand the Asian market trends.

What is the Shanghai Composite Index (China)?

The Shanghai Composite Index is one of the main stock market indices in China. It tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange (SSE).

It reflects how the overall stock market in Shanghai is performing.

Key Facts:

| Point | Details |

|---|---|

| Exchange | Shanghai Stock Exchange (SSE) |

| Number of Companies Tracked | 2,000+ (All A-shares and B-shares) |

| Location | Shanghai, China |

| Index Type | Market-cap weighted index |

| Launched | July 15, 1991 |

What Does It Represent?

The index shows how major Chinese companies (both state-owned and private) are performing in the stock market.

- When the Shanghai Composite goes up, it reflects positive sentiment in the Chinese economy.

- When it goes down, it reflects caution, uncertainty, or weakness in the market.

Major Sectors Covered:

- Finance

- Manufacturing

- Energy

- Technology

- Healthcare

Notes:

It is often seen as China’s equivalent of the Sensex or S&P 500.

This index is a key indicator for international investors to gauge the health of China’s stock market.

Hang Seng Index (Hong Kong)

The Hang Seng Index (HSI) is the main stock market index of Hong Kong. It tracks the performance of the top 50 largest companies listed on the Hong Kong Stock Exchange (HKEX).

It is often considered the benchmark index for the Hong Kong stock market.

Key Facts:

| Point | Details |

|---|---|

| Exchange | Hong Kong Stock Exchange (HKEX) |

| Number of Companies Tracked | 50 (largest and most liquid) |

| Location | Hong Kong |

| Index Type | Free-float market capitalization weighted |

| Launched | November 24, 1969 |

What Does It Represent?

The Hang Seng Index reflects the overall health and performance of the Hong Kong stock market.

- It includes companies from key sectors like Finance, Utilities, Properties, Commerce, and Technology.

- These companies often have strong business ties to mainland China, so the index also acts as a barometer of China’s economic influence.

Sector Composition:

- Financials (banks, insurance)

- Real Estate

- Technology (like Tencent)

- Consumer Goods

- Utilities and Energy

Notes:

- The HSI is seen globally as the key indicator of Asian market sentiment, especially for investors focusing on China.

- It works similarly to the Sensex in India or the Dow Jones in the U.S.

Global markets-India’s impact

Movements in global indices like the Dow Jones, Nasdaq, S&P 500, DAX, and Nikkei often set the tone for Indian markets, especially at the opening. Here’s how:

- US Markets: A strong Nasdaq or S&P 500 signals investor confidence in risk assets, which boosts sentiment in Indian equities, especially tech stocks.

- Crude Oil Prices: India is a major oil importer. If crude prices rise, it increases India’s import bill and weakens the rupee, impacting inflation-sensitive sectors.

- USD/INR Trends: A stronger dollar affects foreign investor sentiment and can lead to FII outflows from Indian markets.

- Asian Markets: Since Indian markets open after Japan and China, early cues from Nikkei and Shanghai often influence Nifty’s opening.

- Global Risk Sentiment: Any tension (like war or rate hikes) in global markets can create volatility in Indian stocks, even if local news is stable.

FII/DII-Who are they?

FII (Foreign Institutional Investors):

These are investment firms based outside India (like hedge funds, pension funds, mutual funds) that invest in Indian stocks, bonds, and other assets. Their buying/selling affects the market sentiment and liquidity.

DII (Domestic Institutional Investors):

These are large Indian investment institutions — such as LIC, SBI Mutual Fund, HDFC AMC, etc. — that invest in Indian markets. DIIs help balance the volatility created by FIIs.

Key Difference:

FII = Foreign money | DII = Indian money

Why They Matter:

Their daily activity (buying or selling) shows where the “smart money” is flowing — a key signal for traders and investors.

Decode signals. Plan your move.

Why it matters:

FII/DII activity isn’t just data — it’s a market signal.

Heavy FII buying? It might signal confidence in the Indian economy.

DII selling? Possibly profit booking or risk aversion.

Smart traders decode these signals to plan their next market move — whether to buy, hold, or exit.

Read More-Vishal Mega Mart Share Price Target 2025 – 88% Profit Jump!

Chambal Fertilisers Share Price Target 2025–2030

Disclaimer: All content shared by STOCK OVERVIEW is purely for educational and informational purposes. We do not provide any investment advice or recommendations. Always seek guidance from a qualified financial advisor before making any trading or investment decisions. We are not liable for any financial gains or losses based on the information shared.

Our Purpose: Educate Before You Invest

before you invest in the market, invest in your understanding.

Why This Matters?

Investing without knowledge is like sailing without a compass.

We believe that every rupee you invest should be backed by clarity, confidence, and calculation.

That’s why our aim is to empower you with simplified research, honest insights, and unbiased analysis.

What We Offer:

Deep-dive analysis in simple language.

Break-down of complex financial terms.

Stock stories with technical + fundamental insights.

No tips. No shortcuts. Just knowledge that builds confidence.

STOCK OVERVIEW, our aim is to support you in your trading journey by providing insights, and updates — so you can make smarter and well-informed decisions.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Contents

- 1 MARKET VIEW

- 2 CHART- SENSEX

- 3 CHART-NIFTY50

- 4 CHART-NIFTY BANK

- 5 INDIA VIX

- 6 Indian Stock Market

- 7 Index (Market Mood / Sentiment)

- 8 Global Stock Market

- 8.1 What is the Dow Jones Industrial Average (DJIA)?

- 8.2 NYSE (New York Stock Exchange)

- 8.3 What is it?

- 8.4 Key Features:

- 8.5 NASDAQ (National Association of Securities Dealers Automated Quotations)

- 8.6 What is it?

- 8.7 Key Features:

- 8.8 NYSE vs NASDAQ – Quick Comparison

- 8.9 NASDAQ – A Stock Exchange:

- 8.10 What is S&P 500?

- 8.11 What is FTSE 100?

- 8.12 What is Nikkei 225 (Japan)?

- 8.13 Hang Seng Index (Hong Kong)

- 9 Global markets-India’s impact

- 10 FII/DII-Who are they?

- 11 Decode signals. Plan your move.