Let’s closely examine Tata Steel’s 1-Day chart (dated 04 August 2025) and analyze which green solid candle has formed after the breakout and what it signifies. Let’s decode Tata Steel Share Price Breakout: Is Tata Steel 159.56 a Smart Buy Right Now?

Tata Steel Share Price Update – 04 August 2025

Price: ₹159.56 | Up by ₹6.55 (+4.28%) Strong rebound from 200 EMA near ₹152 – indicating buying interest . Stock reclaims 55 EMA zone, showing short-term momentum revival Technical support confirmed around 200 EMA, acting as a trend base If price sustains above ₹160, next resistance seen near ₹164–₹166. Ideal for short-term swing buyers; caution advised below ₹153

Update-Tata Steel – Technical Status (As of 16 May 2025)

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Current Price: ₹157.61

Trend: Bullish recovery

Time Frame: Daily

Key Observations from the Chart:

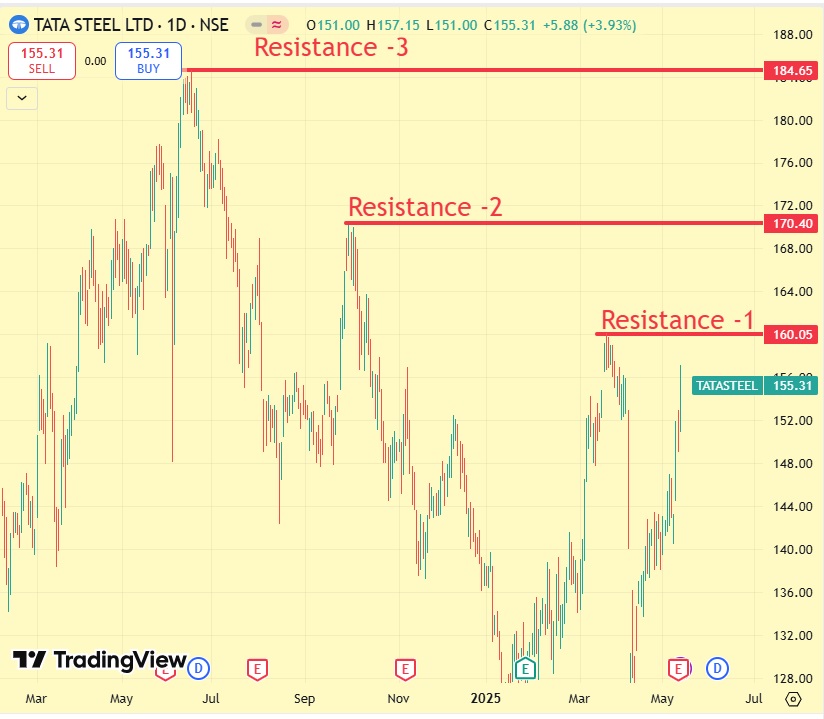

Approaching Resistance:

- The price is very close to the resistance zone around ₹160.32.

- This area has previously caused a reversal — chances of selling pressure are high here.

Strong Rally:

- The recent move from around ₹130 to ₹157.61 is sharp and steep, which often leads to short-term correction or consolidation.

Chart Pattern Breakout:

- You’ve marked a chart pattern breakout near the support zone (great job!) — this triggered the current rally.

- But prices often retest breakout zones, so a pullback is possible.

Volume Spike:

Volume has increased recently, confirming buying interest — but at resistance, it can also mean distribution.

Conclusion: Wait Instead of Buying Now

Not an ideal entry point.

Because:

Risk-reward is not favorable.

Price is at or near a resistance.

Upside is limited from here.

Strategy

- Wait for a pullback near ₹145–₹148 (just above the grey demand zone).

- Buy only if:

- It forms a bullish candle with support confirmation.

- Or breaks above ₹160.32 with volume, then wait for a retest to enter.

Last update-15 May 2025

Tata Steel shares witnessed a strong rally today, and several key factors contributed to this surge. Let’s break down the major reasons behind this impressive performance.

Tata Steel’s stellar performance today highlights the strength of the metal sector.

With global support, solid fundamentals, and positive corporate developments, Tata Steel has once again proven why it remains a favorite among both retail and institutional investors.

The 2025 outlook and upcoming dividend announcement further fueled the Tata Steel Share Price Breakout.

Q4FY25 Financial Highlights

| Net Profit ₹1201 Cr |

| Dividend ₹3.60/Share |

| Quarterly Performance (YoY) |

| Profit Doubled: ₹554 Cr → ₹1201 Cr |

| Revenue fell: ₹58687 Cr → ₹56283 Cr |

| Dividend Announcement: |

| ₹3.60 per share on Face Value ₹1 |

| Record Date: 6 June 2025 |

| AGM: 2 July 2025 |

| Past 4 Quarter Profit: |

| Jun ₹525 Cr → Sep ₹521 Cr → Dec ₹295 Cr → Mar ₹1201 Cr |

| Stock Price Action: |

| Current Market Price- 155.31 |

| 52W High: ₹185 |

| Future Plan: |

| $2.5 Billion Investment in Overseas Business |

| Accounting Policy Change in Focus |

MARKET NEWS

Market Overview

Today, the overall market remained volatile, with both buying and selling pressure evident throughout the day.

The Sensex closed at 81,330.56, forming a Doji candle — a technical indicator that reflects indecision in the market.

Despite the choppiness, the metal sector outperformed, and Tata Steel led this rally from the front.

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Impact of India-US Developments

One of the biggest catalysts for this upward movement is the positive shift in India-US trade relations, especially regarding steel and metal imports.

Recent policy updates from the U.S. are expected to benefit Indian metal exporters — and Tata Steel, with its strong global presence, stands to gain significantly.

Dividend Declaration News

Tata Steel has also announced a dividend, and the company has already disclosed the record date.

Investors holding Tata Steel shares on the record date will be eligible for this dividend payout.

Q4 Results & Financial Performance

In its latest Q4 earnings report, Tata Steel delivered better-than-expected performance:

- Margins showed improvement

- Revenue and net profit exceeded expectations

- Debt levels declined, and operational efficiency improved

According to Tata Steel management, the Q4 EBITDA was ₹710 Cr, which is in-line with estimates.

Nomura expects that in Q1FY25, the company may earn ₹2000 more per tonne compared to last quarter.

Why?

- Steel prices are rising

- Raw material cost (coal) is falling

However, volume may be slightly lower, which might balance out the gains.

This has further boosted investor confidence in the company’s growth outlook.

In this analysis, we explore whether this is the right time to buy the stock and what investors can expect in the near future.

Investment Plan

Tata Steel has announced a ₹15,000 crore investment plan for FY26 to expand operations in India, UK, and Netherlands.

- 80% of this ₹15,000 Cr will be invested in India

- ₹1,000 Cr in the UK

- ₹100 Cr in the Netherlands

This clearly shows Tata Steel is focused on domestic expansion, completing ongoing projects in India.

Inflation & Global Impact

Another reason for today’s metal rally is the decline in inflation in both India and the US.

- India’s April CPI fell to 3.16%, which gives hope that RBI may cut rates in the upcoming June policy.

- HDFC Bank predicts a 25 bps rate cut, while IDFC Securities suggests up to 50 bps cut for supporting growth.

This cooling inflation is creating a positive outlook for rate-sensitive sectors including metals.

Global Trade Developments

There’s also a positive development in US-China trade talks — tariff wars are likely to cool off.

This is helping sentiment in global metal markets.

Meanwhile, India is pushing back against US tariffs on steel and aluminium.

- India has proposed counter tariffs at the World Trade Organization (WTO)

- 29 US goods (like apples, almonds, walnuts, chemicals) may face equal counter tariffs

- This is expected to pressurize the US to reduce its import duties

Such moves signal a strong global positioning for Indian steel players like Tata Steel.

Tata Steel Q4 Results – Summary

| Metric | Q4 FY24 | Q4 FY23 |

|---|---|---|

| Revenue | ₹56,790 Cr | ₹58,630 Cr |

| Net Profit | ₹1,210 Cr | ₹555 Cr |

Quarter-on-quarter, revenue has increased

But year-on-year, revenue declined slightly

Profit more than doubled, which is very positive

So friends, there are multiple reasons why Tata Steel is rallying today:

- Bullish outlook from brokerages

- ₹15,000 Cr investment plan with 80% focus on India

- Declining inflation in India & US

- Possibility of interest rate cuts

- US-China trade easing

- India’s bold stand at WTO

- Q4 profit more than doubled

All these factors are creating strong momentum in Tata Steel and the metal sector as a whole.

If you’re a long-term investor, keep an eye on Tata Steel. The fundamentals are improving and the global outlook is turning favorable.

Technical Analysis

Monthly and Weekly Chart Summary

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

On the monthly chart, we will focus only on identifying the major support and resistance levels.

On the weekly chart, we primarily analyze the trend direction.

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

Daily Chart & Summary

The securities quoted are for illustration purposes only and are not recommendatory. Chart reading is explained here only for knowledge purposes — to help you understand how to interpret financial data.

| Indicator | Status |

| RSI | 65.67 bullish |

| Stochastic | Overbought (pco) |

| Volume | Above Average |

| Moving Averages (50/200 EMA) | Price Above Both Averages (Uptrend) |

| Trend-weekly positive | bullish – upward |

Chart Analysis Summary (Daily Timeframe)

Price Level & Pattern

Current Price: ₹155.66 (15.05.2025)

The stock has recently crossed above the 50 and 200 DMA, which is a bullish signal.

There have been 6-7 consecutive green candles, indicating active momentum buyers.

Volume

Volume has increased, supporting the breakout.

After the recent correction, a strong V-shape recovery has formed.

Risk Zones

Resistance Level: ₹158–₹160 (short-term profit booking possible)

Support Zone: ₹146 and ₹140 (major decline likely to stop around these levels)

So, Should You Buy Now?

| Investment Horizon | Recommendation |

|---|---|

| Short-Term (1–2 weeks) | Wait for a dip or small correction – stock is in overbought zone. |

| Medium to Long-Term (3 months – 1 year) | Yes, buy in parts or on dip – strong outlook with solid fundamentals. |

Risk Management –

Enter partially now

Add more on dip

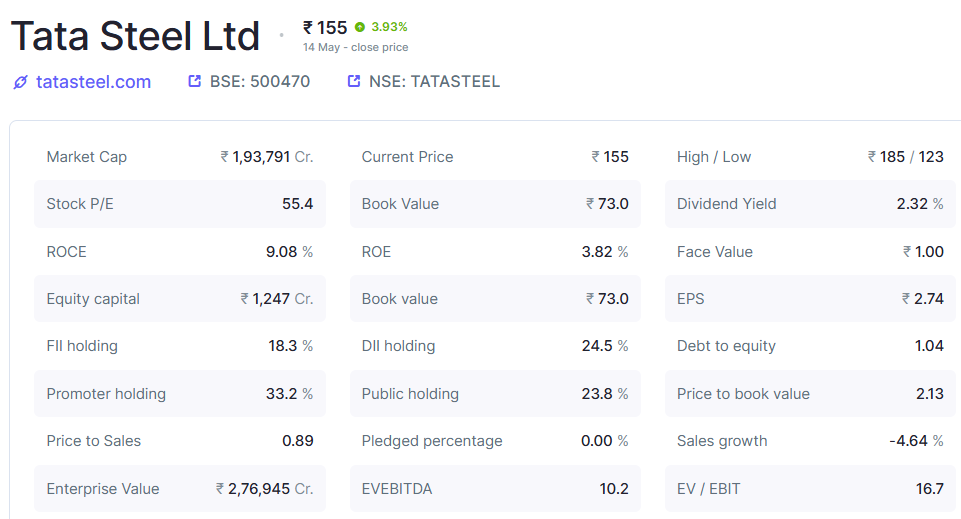

Fundamental Analysis

Tata Steel Ltd is one of India’s oldest and most recognized steel companies. But is it a fundamentally strong stock to hold in your portfolio? Let’s break it down based on the latest data:

Strong Points of Tata Steel

| Metric | Value | Why It’s Positive |

|---|---|---|

| Dividend Yield | 2.32% | Attractive for long-term income investors |

| ROCE (Return on Capital Employed) | 9.08% | Good operational efficiency |

| Promoter Holding | 33.2% | Strong promoter confidence |

| Pledged Shares | 0.00% | No risk of promoter pledging |

| Enterprise Value | ₹2.76 Lakh Cr | Shows strong valuation in the market |

| EV/EBITDA | 10.2 | Fairly valued on EBITDA basis |

Weak Points of Tata Steel

| Metric | Value | Why It’s Concerning |

|---|---|---|

| Stock P/E Ratio | 55.4 | Overvalued as per earnings |

| ROE (Return on Equity) | 3.82% | Low return to shareholders |

| EPS (Earnings Per Share) | ₹2.74 | Indicates weak profitability |

| Sales Growth | -4.64% | Negative growth is a red flag |

| Debt to Equity Ratio | 1.04 | Slightly high debt level |

| Price to Book Value | 2.13 | Trading at a premium to book value |

Summary – Is Tata Steel Fundamentally Strong?

- Valuation: Overvalued (High P/E & P/B)

- Profitability: Moderate (Good ROCE, but low ROE & EPS)

- Growth: Negative sales growth is a concern

- Debt: Slightly risky (D/E > 1)

- Promoter Confidence: High (33.2% holding, no pledge)

- Dividends: Good (2.32% yield)

Tata Steel has strong promoter backing and pays regular dividends. However, its high valuation and weak profitability metrics suggest caution. Long-term investors should closely monitor debt and earnings growth before making fresh investments.

Mastering Fundamentals

Understanding Book Value and Fundamental Screening – From Beginner to Advanced

What is EBITDA?

EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization

EBITDA tells you how much profit a company makes from its core business operations before deducting:

- Interest – cost of borrowing money

- Taxes – government payments

- Depreciation – decrease in value of physical assets (like machines) over time

- Amortization – decrease in value of intangible assets (like patents)

So, EBITDA focuses only on the business performance, ignoring things like loan interest or tax rules.

Let’s say XYZ COMPANY reported:

Revenue (Total Sales) = ₹2,547.9 Cr

Operating Expenses (like salaries, rent, cost of goods) = ₹2,190.9 Cr

Then,

EBITDA = Revenue – Operating Expenses

= ₹2,547.9 Cr – ₹2,190.9 Cr =₹357 Cr

This means XYZ COMPANY earned ₹357 Cr from its core business operations, before paying for:

- Bank interest (loans)

- Taxes (government dues)

- Depreciation (value loss of machinery)

- Amortization (value loss of intangible things like software, licenses)

Book Value-

Book Value is the amount a shareholder would receive if the company is liquidated and all liabilities are paid off.

| Formula: |

| Book Value per Share = (Total Assets – Total Liabilities) ÷ Total Number of Shares |

| Or simply: Book Value = Equity ÷ Total Shares |

What is Equity?

| Equity = Total Assets – Total Liabilities |

| Note: Equity ≠ Share |

| It is the remaining value after debts are cleared, and belongs to shareholders. |

| Simple Example |

| Three students start a sandwich business. |

| Borrow ₹60 → this is their liability |

| Earn ₹120 by selling sandwiches → this is their asset |

| Repay ₹60 loan → Equity = ₹60 |

| 3 students = 3 shareholders → each gets ₹20 |

| Book Value per Share = ₹20 |

| Why is Book Value Important? |

| If Book Value is Negative → Company has more debt than assets → Risk of getting nothing during liquidation. |

| If Book Value is very low (e.g., ₹1–₹2) → Risky investment. |

Why Ignore Stocks with Negative or Low Book Value?

When screening over 3,000 companies for value investing:

- Eliminate stocks with negative book value

- Ignore companies with book value less than ₹10

This simple filter removes around 994 companies at the very first step.

Stocks with negative or extremely low book value may signal weak financials or high risk, so it’s wise to avoid them early in your analysis.

ROE / RONW (Return on Equity / Net Worth)

| Formula: ROE = (Net Profit ÷ Shareholder’s Equity) × 100 |

| Good ROE: Above 3% |

| Negative ROE: Bad sign (company not profitable) |

EPS (Earnings per Share)

| Formula: EPS = (Net Profit – Preferred Dividend) ÷ Number of Outstanding Shares |

| Positive EPS = company is profitable |

| Negative EPS = company in loss → be cautious |

Net Sales Per Share and P/S Ratio

| Formula: P/S = Price per Share ÷ Net Sales per Share |

| P/S Ratio > 2 → Overvalued |

| P/S Ratio > 3 → High risk (needs deeper analysis) |

Enterprise Value (EV)

| Formula: EV = Market Cap + Total Debt – Cash & Equivalents |

| EV shows how much it would cost to buy the whole company |

| Negative EV = Company has too much cash → may not be using it effectively |

Promoter Pledged Shares and Promoter Pledge:-

| Same Concept – Minor Wording Difference |

| Promoter Pledge: A general term — it means promoters have pledged (i.e., used as collateral) some of their shares. |

| Promoter Pledged Shares: This refers to the actual percentage or quantity of shares pledged by the promoters. |

| Example: |

| “Promoter Pledge is high” = Promoters have pledged a large portion of their holdings. |

| “Promoter Pledged Shares = 70%” = 70% of the promoter’s shares are pledged. |

Sales (Revenue) – The Most Honest Metric

Sales can’t be faked easily. If sales are growing consistently → it shows demand is real, even if profits fluctuate.

When we talk in percentage terms, we’re referring to Sales Growth, not just total sales.

| Example: |

| FY23 Sales: ₹80 crore |

| FY24 Sales: ₹100 crore |

| Then: |

| Sales = ₹100 crore |

| Sales Growth = 25% |

| So, when someone says “The company’s sales grew by 25%”, they are actually talking about sales growth, not just revenue. |

Should I Buy Tata Steel Now?

- The stock is trading at high valuation (P/E: 55.4)

- Profit and sales growth are weak (EPS: ₹2.74, Sales Growth: -4.64%)

- The company has moderate debt (D/E: 1.04)

If you are a long-term investor, it’s better to wait for a price correction or strong quarterly results.

If you’re a short-term trader, make decisions based on technical analysis only.

Conclusion

Wait for a better entry point — this is not the best time to buy.

If your view is for the short term, you should closely analyze technical indicators like chart patterns, support–resistance levels, volume, RSI, and moving averages.

What is the Future Outlook of Tata Steel (2025–2026)?

Here’s how Tata Steel plans to allocate its capital globally over the next two years:

- 80% will be invested in India,

- ₹1,000 Cr in the UK,

- ₹100 Cr in the Netherlands.

This clearly shows the company’s focus on Indian expansion and completing key projects.

If demand improves and investment plans succeed, Tata Steel can perform well in 2025–2026. Short-term caution advised, but Tata Steel has strong long-term potential.

What is Tata Steel’s capital allocation plan for FY 2025–2026 across geographies?

Tata Steel plans to invest 80% in India, ₹1,000 Cr in the UK, and ₹100 Cr in the Netherlands.

How much of Tata Steel’s future investment is focused on India, and why?

80% of Tata Steel’s investment is focused on India to capitalize on strong domestic growth and demand potential.

Read More

Share Market wrap 14 may 2025: Sensex 81330 Nifty 24666

Vishal Mega Mart Share Price Target 2025 – 88% Profit Jump!

Suzlon Energy 2025: Big Renewable Update & Price Target

Our Purpose: Educate Before You Invest

Before you invest in the market, invest in your understanding.

Why This Matters?

Investing without knowledge is like sailing without a compass.

We believe that every rupee you invest should be backed by clarity, confidence, and calculation.

That’s why our aim is to empower you with simplified research, honest insights, and unbiased analysis.

What We Offer:

Deep-dive analysis in simple language.

Break-down of complex financial terms.

Stock stories with technical + fundamental insights.

No tips. No shortcuts. Just knowledge that builds confidence.

STOCK OVERVIEW, our aim is to support you in your trading journey by providing insights, and updates — so you can make smarter and well-informed decisions.

Why Learning is Important for You?

Learning empowers you to take better decisions, reduces dependency on others, and helps you grow with confidence. Even expert advice makes more sense when you start learning yourself.

Disclaimer:

All content shared by STOCK OVERVIEW is purely for educational and informational purposes. We do not provide any investment advice or recommendations. Always seek guidance from your financial advisor before making any trading or investment decisions. We are not liable for any financial gains or losses based on the information shared.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.