In this blog, we’ll take a look at the latest gold and silver prices as of 16th July 2025. You’ll find updated rates from trusted sources like IBJA, MCX, and international markets, along with insights into how prices have moved in recent trading sessions.

Whether you’re an investor or someone who closely follows the bullion market, this report will provide valuable information. Not only will you get today’s rates, but also a brief and useful analysis of current trends and what they could mean going forward.

We’ll also explain what today’s movement means for investors and traders. Let’s break it down in simple words-Gold Price Today 16 July 2025

Gold & Silver Rates – 16 July 2025

Gold and silver prices will be updated between 12:00 PM and 12:30 PM IST. The earlier rates remain valid until the update.

| Purity | AM Rate (₹) | PM Rate (₹) |

|---|---|---|

| Gold 999 | 97,460 | 97,500 |

| Gold 995 | 97,070 | 97,110 |

| Gold 916 | 89,273 | 89,310 |

| Gold 750 | 73,095 | 73,125 |

| Gold 585 | 57,014 | 57,038 |

| Silver 999 | 1,10,996 (Kg) | 1,11,200(Kg) |

Gold and silver prices are officially updated after 12:00 PM and 5:00 PM IST every day.

Gold & Silver Market Rates (16 July 2025)

Current View

| Name (Approx) | Last Price | Currency |

|---|---|---|

| Gold Futures (COMEX) | 3,360.7 | USD |

| Gold Spot | 3,367.89 | USD |

| Gold (India) MCX | 98,123 | INR |

| Gold Bees ETF (India) | 81.35 | INR |

| Silver Futures (COMEX) | 38.080 | USD |

| Silver Spot | 37.9749 | USD |

| Silver (India) MCX | 111,909 | INR |

| Silver Bees ETF (India) | 107.79 | INR |

Why do Gold and Silver prices change daily?

The prices of gold and silver fluctuate daily due to global factors such as:

- International market trends (like COMEX)

- USD-INR exchange rate

- Inflation data

- Interest rates

- Geo-political tensions

- Demand and supply variations

Any major economic or political news can cause sudden price movements.

What’s the difference between MCX and IBJA rates?

- MCX (Multi Commodity Exchange): Live prices for gold and silver as traded in Indian futures markets (suitable for investors and traders).

- IBJA (Indian Bullion Jewellers Association): Practical benchmark prices used by jewellers across India (used for retail jewellery buying/selling).

Both are accurate — the use depends on your purpose.

Let’s Understand Why Investing in Gold ETFs Makes Sense

Gold ETF: The Smartest Way to Invest in 2025

Gold has always been a trusted investment. When prices rise, people say, “Wish I had bought earlier!”

When prices drop, they say, “Now is the right time!” That’s why gold is considered an evergreen asset — always relevant, always in demand.

Budget 2024 Boosted Gold Investment

The 2024 Union Budget reduced excise duty on gold, making it slightly cheaper. This opened up an excellent opportunity for investors — especially through Gold ETFs, which offer both affordability and flexibility.

What is a Gold ETF?

A Gold ETF (Exchange Traded Fund) is a mutual fund that invests in gold but trades like a stock on exchanges.

No need to buy or store physical gold — just open a Demat account, and the gold ETF units are held securely in your name.

Key Benefits of Gold ETFs

- Start with as low as ₹1 or 1 unit (1g of 99.5% purity gold)

- Trades at NAV-based prices

- Enjoy Rupee Cost Averaging (like SIPs)

- No locker, no theft, no purity concerns

- Highly liquid – Buy or sell anytime

- Low annual cost – only 0.1% to 0.5%

Expert Advice

Most experts recommend allocating 10% to 15% of your total portfolio to gold.

Gold ETFs are considered ideal: low cost, flexible, tax-efficient, and secure.

Gold Price Outlook – July 2025 Update

- As of 15 July 2025, gold is trading between ₹99,000 and ₹1,04,000 per 10 grams

- Gold has already delivered a 27% year-to-date return in 2025

- Technical indicators (RSI, MACD, Bollinger Bands) are pointing toward continued upside

- According to analysts, gold may touch ₹1,10,000 per 10 grams in the next 6–12 months

Final Thoughts

If you want to invest in gold but want to avoid physical gold or jewelry, then Gold ETFs are your best bet:

Affordable

Easy to buy/sell

Highly secure

And best of all, you can ride the current rally confidently.

Gold Trading Hours

Spot Gold Market (24-Hour Trading – Key Opening Times):

- Sydney Open: 3:30 AM IST

- Tokyo Open: 5:30 AM IST

- London Open: 1:30 PM IST

- New York Open: 6:00 PM IST

Spot Gold Market – Key Closing Times:

- Sydney Close: 12:30 PM IST

- Tokyo Close: 2:30 PM IST

- London Close: 11:30 PM IST

- New York Close: 2:30 AM IST (next day)

National Stock Exchange-

NSE (Equity & ETFs) – Opening Time 9:15 AM, Closing Time 3:30 PM

MCX Exchange-

MCX (Commodities)– Opening Time 9:00 AM, Closing Time 11:30 PM/11:55 PM

MCX Trading Time & DST Impact

Impact of Daylight Saving Time (DST) on Global Markets

DST affects only those markets that are influenced by international trading hours, such as COMEX, NYMEX, and the MCX Futures Market.

When DST is in effect (from March to November), MCX closes at 11:55 PM IST.

During the rest of the year, MCX closes at 11:30 PM IST.

Where is DST observed?

Daylight Saving Time is observed in countries like the United States, Canada, United Kingdom, Europe, and Australia.

However, India, UAE, Saudi Arabia, and many Asian countries do not observe DST.

Troy Ounce

What is a Troy Ounce? Why is it used for Gold and Silver?

The Troy system is a special weight measurement system primarily used to measure gold, silver, and other precious metals.

1 Troy Ounce (oz) = 31.1035 grams

This is heavier than a regular ounce.

In the standard Avoirdupois system (used for most everyday items),

1 ounce = 28.35 grams, whereas

1 Troy ounce = 31.1035 grams.

That’s why whenever we see the prices of gold or silver in the global market, they are always quoted in Troy ounces, not in regular ounces.

Gold Price & Calculations

GOLD1 vs GOLD2 on TradingView

Difference Between GOLD 1 and GOLD 2 Contracts in MCX Futures

GOLD 1 – Near-Month Expiry:

MCX Futures offer multiple gold contracts with different expiry dates. The near-month contract, such as one expiring in March 2025, usually has higher trading volume because it is closer to the current date.

That’s why its price is often used as the benchmark.

GOLD 2 – Far-Month Expiry:

The far-month contract (next future month) typically trades at a higher price than the near-month.

This happens due to the Contango effect, where future prices are higher than the spot or near-term futures — mainly because of storage costs, interest rates, and other factors.

Contango Effect

The price of the near-month contract is slightly lower than the far-month contract. The price of the next-month contract is higher because it includes carry costs and interest. It may also include a risk premium.

Carry costs include expenses like storage, insurance, and other related expenses.

Long-term holding: Holding a position for a longer period can lead to an increase in price.

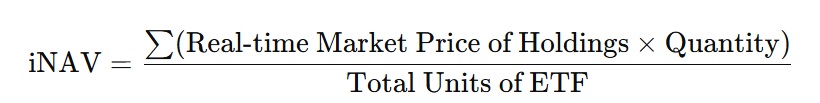

What is iNAV (Indicative Net Asset Value)?

The full form of iNAV is Indicative Net Asset Value. It is an estimated NAV that gets updated continuously throughout the trading session. iNAV is calculated specifically for ETFs (Exchange Traded Funds) to help investors understand the real-time value of the fund during market hours.

How is iNAV Calculated?

The formula for iNAV is:

Or in simple terms,

iNAV = (Total real-time market value of ETF holdings) ÷ (Total ETF units)

Difference Between NAV and iNAV

| Criteria | NAV | NAV |

| Timing | Calculated once a day (EOD) | Updates in real-time |

| Calculation Basis | Based on closing market prices | Based on live price movements |

| Used For | Mutual funds & ETFs | Primarily for ETFs |

Ways to Buy Gold in India

Physical Gold

Digital Gold

Gold Exchange Traded Funds

Gold Mutual Funds

Gold Futures & Options

Gold & Silver Rates

International Market

Demand & Supply

Inflation & Interest Rates

Government Policies & Taxes

Stock Market & Economic Crisis

Geopolitical Events

Why Gold and Silver Are So Expensive?

Why Gold and Silver Prices Remain High

Natural Scarcity:

Gold and Silver are naturally scarce metals found in limited quantities on Earth. Their mining and extraction processes are expensive, complex, and time-consuming, which adds to their overall value.

High Demand:

The demand for Gold and Silver has always remained strong. They are widely used in jewelry, investments, industrial applications, and central bank reserves — making them highly sought-after across the world.

Inflation & Economic Crisis:

During times of rising inflation or economic uncertainty, people naturally turn to Gold and Silver as safe-haven assets. This increased buying often pushes their prices even higher.

Impact of USD & INR:

Gold and Silver rates in the international market are denominated in U.S. dollars (USD). If the dollar strengthens or the Indian rupee (INR) weakens, the prices of Gold and Silver in India tend to rise accordingly.

Purity & Making Charges:

When you buy Gold or Silver jewelry, the final price includes additional costs like making charges, GST, and other taxes — making the purchase more expensive than just the raw metal rate.

Gold and Silver are not just metals; they are considered safe and valuable investments.

That’s why their prices usually stay strong over time.

If you are a long-term investor, investing in Gold and Silver right now could be a wise option. Although short-term volatility may occur, historically, Gold and Silver have provided good returns over longer periods.

Check Gold and Silver Rates Here

We can check the Gold and Silver rates, ETF trading prices, and iNAV on websites like Moneycontrol and the NSE (National Stock Exchange).

When inflation rises, Gold and Silver rates also tend to increase.

Which chart should you use for trading Gold and Silver?

International Chart

Is gold a good option for hedging during a market downturn?

Yes, because it is considered a safe investment.

Are gold and silver charts the first choice for traders?

Yes, to easily understand the market.

Why do people prefer trading in gold and silver?

Hedging tool, Volatility, High liquidity, Safe-haven assets

What percentage of your portfolio should you allocate to gold and silver to remain profitable even during a market downturn?

safe investors: 10-15% gold & silver

moderate risk: 5-10% gold & silver

High-risk traders: 2-5% gold & silver

Proportion depends on investment goals and risk tolerance.

Gold remains one of the most trusted and valuable assets in global and Indian markets. From daily price updates and ETF performance to MCX trends and international benchmarks like the London Bullion Association Rate, investors must stay informed to make wise decisions.

Whether you’re tracking spot prices, futures, or technical charts, this complete gold market coverage gives you a sharp, updated perspective — all in one place. Stay connected for real-time insights and actionable analysis.

Read more

NIFTY BANK Weekly Important Update April 25, 2025

7 Powerful Bull Run Clues: Will the Rally Return Now?

Ujjivan SFB Share Price Target 2025 to 2030 | Expert Analysis

Chambal Fertilisers Share Price Target 2025–2030

Nifty 50 Weekly Outlook – Important Update April 17, 2025

Nifty 50 Share Price Target 2025 |Crash or Recovery?

Silver Share Price Target 2025: Analysis and outlook

Gold Price Forecast 2025: अब सोने में निवेश करें या इंतजार ?

Crude Oil Share Price Target 2025| Analysis & Outlook

NSE Website update 2025: जानें Best फीचर्स और बदलाव

Intraday to Delivery: Avoid This Big Mistake!

ETFs Share Price Target 2025 – Buy Low, Sell High Strategy

Why Are ETFs Best for Swing Trading?

Are ETFs like mutual funds? free education 2025

ETF से Risk-Free कमाई के Best Secrets

Disclaimer:

All content shared by STOCK OVERVIEW is purely for educational and informational purposes only. We do not provide any investment advice or stock recommendations. Please consult a SEBI-registered financial advisor before making any trading or investment decisions. This content is created solely to help and guide you with market awareness. STOCK OVERVIEW will not be held responsible for any financial gains or losses arising from the use of this information.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Contents

- 1 Gold & Silver Rates – 16 July 2025

- 2 Gold & Silver Market Rates (16 July 2025)Current View

- 3 Gold ETF: The Smartest Way to Invest in 2025

- 4 Budget 2024 Boosted Gold Investment

- 5 What is a Gold ETF?

- 6 Key Benefits of Gold ETFs

- 7 Expert Advice

- 8 Gold Price Outlook – July 2025 Update

- 9 Final Thoughts

- 10 Gold Trading Hours

- 11 MCX Trading Time & DST Impact

- 12 Troy Ounce

- 13 Gold Price & Calculations

- 14 GOLD1 vs GOLD2 on TradingView

- 15 Contango Effect

- 16 What is iNAV (Indicative Net Asset Value)?

- 17 Ways to Buy Gold in India

- 18 Gold & Silver Rates

- 19 Why Gold and Silver Are So Expensive?

- 20 Check Gold and Silver Rates Here

- 20.1 Which chart should you use for trading Gold and Silver?

- 20.2 Is gold a good option for hedging during a market downturn?

- 20.3 Are gold and silver charts the first choice for traders?

- 20.4 Why do people prefer trading in gold and silver?

- 20.5 What percentage of your portfolio should you allocate to gold and silver to remain profitable even during a market downturn?