What Happened in the Market Today? (28th May 2025)

Share Market wrap 28 May 2025: Sensex 81312 Nifty 24752- Let’s decode

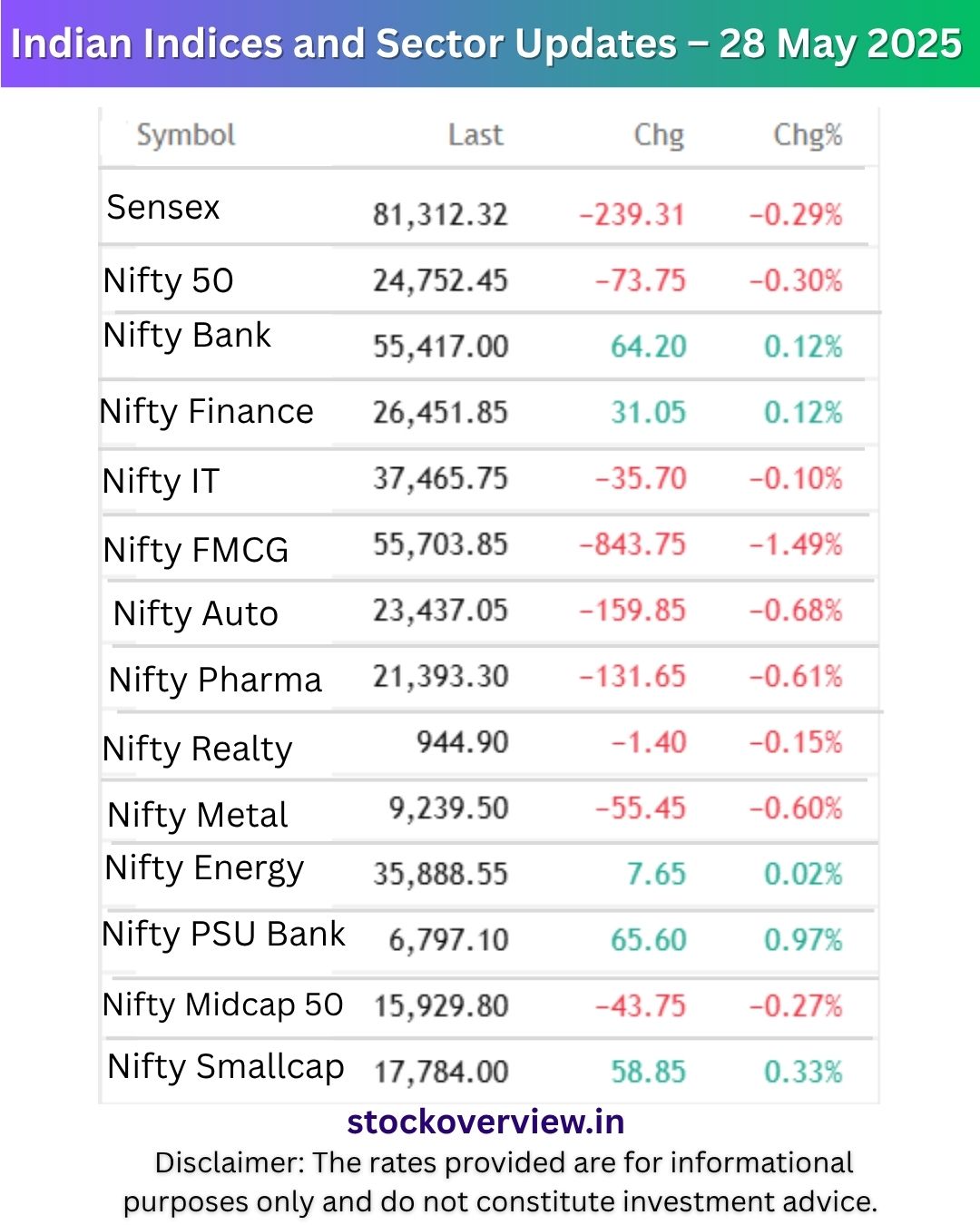

Indices & Sector Performance Summary

The stock market showed a mixed trend today. While some sectors experienced buying interest, others came under heavy selling pressure.

Declining Sectors:

- CNXFM (Financial Services): Biggest drop at -1.49%, indicating pressure on the financial space.

- CNXAU (Auto), CNXPH (Pharma), CNXME (Metals): Also in the red due to investor caution.

- SENSEX and NIFTY ended slightly lower.

Gaining Sectors:

- CNXPSI (Public Sector Enterprises): Up nearly 1%, showing strong investor interest in PSU stocks.

- CNXSM (Smallcap) and BANKN (Banking): Posted mild gains.

- Energy and CNXFIN (Financial Services): Stable with minor upticks.

The market remained volatile with profit booking in major sectors while selective buying supported smallcaps and PSUs.

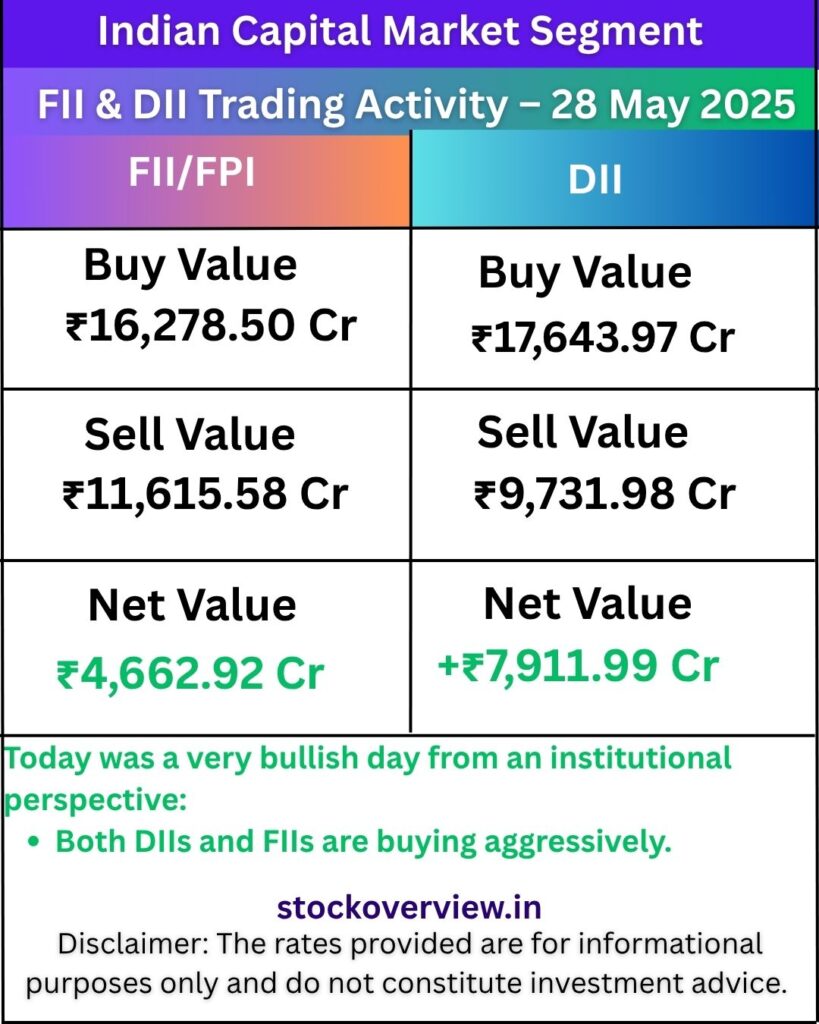

FII and DII Activity-28 May 2025

| Category | Buy Value (₹ Cr) | Sell Value (₹ Cr) | Net Inflow (₹ Cr) |

|---|---|---|---|

| DII | ₹17,643.97 | ₹9,731.98 | ₹7,911.99 Inflow |

| FII/FPI | ₹16,278.50 | ₹11,615.58 | ₹4,662.92 Inflow |

What does this mean?

- DIIs (like mutual funds, LIC, banks, etc.) were major buyers today.

- They bought ₹17,643.97 Cr worth of stocks and sold only ₹9,731.98 Cr.

- Net Inflow: ₹7,911.99 Cr → This shows strong confidence from domestic institutions in the market.

FII/FPI Activity:

- FIIs (foreign investors) also remained net buyers, though to a slightly lower extent.

- They bought ₹16,278.50 Cr and sold ₹11,615.58 Cr.

- Net Inflow: ₹4,662.92 Cr → Positive sign as FIIs often drive short-term trends.

Conclusion:

Today was a very bullish day from an institutional perspective:

- Both DIIs and FIIs are buying aggressively.

- This kind of double inflow often indicates market support and possible short- to mid-term upward movement.

CHART-NIFTY-50

CHART-NIFTY BANK

Disclaimer:

The securities quoted are for illustration only and are not recommendatory. This content is purely for educational and understanding purposes only.

INDIA VIX

Major NIFTY Indices – A Simple Explanation

The NIFTY Index encompasses more than just the NIFTY 50, as it includes various sector-specific indices that track different segments of the Indian stock market. Below is a detailed table for your reference:

| Index Name | Sector Focus & Examples |

| NIFTY 50 | Top 50 large-cap companies Reliance, TCS, Infosys |

| BANK NIFTY Nifty Bank | Banking Sector HDFC Bank, ICICI Bank, SBI |

| FINNIFTY Nifty Financial Services | Finance, NBFC, Insurance Bajaj Finance, HDFC, SBI Life |

| NIFTY IT Nifty Information Technology | IT Services TCS, Infosys, Wipro |

| NIFTY FMCG | Consumer Goods HUL, Nestle, Britannia |

| NIFTY AUTO | Automobile Sector Tata Motors, M&M, Bajaj Auto |

| NIFTY PHARMA | Pharmaceuticals Sun Pharma, Cipla, Dr. Reddy’s |

| NIFTY REALTY | Real Estate DLF, Godrej Properties, Oberoi Realty |

| NIFTY METAL | Metals and Mining JSW Steel, Tata Steel, Hindalco |

| NIFTY ENERGY | Energy Sector NTPC, ONGC, Power Grid |

| NIFTY PSU BANK | Government Banks SBI, Bank of Baroda, Canara Bank |

| NIFTY MIDCAP 50 | Top 50 Midcap Companies Tube Investments, Max Financial |

| NIFTY SMALLCAP 100 | Top 100 Smallcap Companies PNB Housing, RBL Bank |

What does the trading data indicate about market sentiment on 28 May 2025?

Institutional buying shows a strong bullish sentiment.

Disclaimer:

All content shared by STOCK OVERVIEW is purely for educational and informational purposes only. We do not provide any investment advice or stock recommendations. Please consult a SEBI-registered financial advisor before making any trading or investment decisions. This content is created solely to help and guide you with market awareness. STOCK OVERVIEW will not be held responsible for any financial gains or losses arising from the use of this information.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.