Golden Opportunity or Risk? Ujjivan SFB Share Price Target 2025 to 2030 | Expert Analysis 22 April, 2025

Before making any investment decision, let’s explore all the key aspects of Ujjivan Small Finance Bank’s share price target for 2025 to 2030 — simplified and insightful

Disclaimer: The securities quoted are for illustration purposes only and are not recommendatory.

Company Overview – Ujjivan Small Finance Bank

| Parameter | Details |

| Name | Ujjivan Small Finance Bank Limited |

| Incorporated | July 4, 2016 (certificate of incorporation) |

| Commenced Ops. | February 1, 2017 |

| Headquarters | Mumbai, Maharashtra, India |

| Promoter / Group | Ujjivan Financial Services Ltd. (UFSL) – holds -80 % stake |

| Key People | Sanjeev Nautiyal (Managing Director & CEO) |

| Industry | Banking & Financial Services (operating as a Small Finance Bank) |

| License Status | RBI‑licensed under Sec 22(1) of Banking Regulation Act, 1949; Scheduled Bank since Aug 2017 |

| Digital Footprint | Internet banking, mobile app, tablet origination, phone banking; multi‑lingual & 24×7 access |

| Services Offered | Savings & Current Accounts, FDs, RDs, Microloans, MSE & Housing Loans, Digital Banking |

| Pan‑India Presence | 753 banking touchpoints across 326 districts, 26 states & Union Territories |

| Customer Base | Over 9.1 million (91 lakh) customers |

| IPO | 2019 IPO oversubscribed ~170 times; top‐performing banking IPO in last four years |

| CIN NO | L65110KA2016PLC142162 |

Ujjivan SFB, born from Ujjivan Financial Services (an NBFC since 2005), has been an RBI‑licensed Small Finance Bank since 2017, serving over 9 million customers with tech‑enabled banking across 26 states in 13 languages.

Committed to financial inclusion, it offers a one‑stop suite of digital and branch‑based services and drives sustainable social impact through community development and financial‑literacy initiatives.

Disclaimer: The securities quoted are for illustration purposes only and are not recommendatory.

Ujjivan Small Finance Bank Limited

Current Price-44.19

Quick Overview

Updated: Data as of 22 April 2025

Weekly Data Snapshot :

| Parameter | Value |

|---|---|

| Current Closing | 42.10 |

| Previous Closing | 39.95 |

| Weekly Change (Price) | +₹2.15 |

| Weekly Change (%) | +5.38% |

| Support Levels | ₹32.88 – ₹30.90 |

| Resistance Levels | ₹47.20 –₹48.10 |

| Pattern Detected | Consolidation Zone Breakout |

| Chart | Candlestick Chart |

| Candlestick Pattern | Bullish green candle |

| Volume (37,511,616 shares) | Average Weekly Volume |

| Trend Indicator(MACD) | Bullish Crossover (Weekly) |

| Weekly (RSI) | 63.35 (Bullish) – Weekly |

| Entry Indicator (RSI) | 70.26 (Bullish) – Daily |

| Entry Indicator(Stochastic) | 93.51(Rising) PCO – Daily |

| Divergence | N/A |

| EMA | Trading above all major EMAs |

| Outlook | Positive above ₹41.05 |

| Downtrend’s Lowest Level | ₹30.88 (52‑week low) |

This summary is for informational purposes only and not a recommendation to buy or sell.

Sources: TradingView

How to Calculate Price and Percentage Change

| Current Closing Price: ₹42.10 |

| Previous Closing Price: ₹39.95 |

| Price Change: |

| = Current Closing − Previous Closing |

| = ₹42.10- ₹39.95 |

| =₹2.15 |

| Percentage Change: |

| = (Price Change ÷ Previous Closing) × 100 |

| = (₹2.15 ÷₹39.95) × 100 |

| = +5.38% |

| So, the market increased by ₹2.15 or +5.38% this week. |

Ujjivan Small Finance Bank – Key Financials (As on Latest Data)-Fundamental Snapshot

Updated: 22 April 2025

| Parameter | Value |

| Market Cap | ₹8,601 Cr. |

| Current Price | ₹44.4 |

| High / Low (52W) | ₹56.2 / ₹30.8 |

| Stock P/E | 8.86 |

| Book Value | ₹30.0 |

| Price to Book Value | 1.49 |

| Dividend Yield | 3.35% |

| EPS (Earnings/Share) | ₹5.01 |

| Face Value | ₹10.0 |

| Equity Capital | ₹1,935 Cr. |

| ROCE | 11.1% |

| ROE | 26.7% |

| Debt to Equity | 6.33 |

| FII Holding | 19.5% |

| DII Holding | 8.47% |

| Public Holding | 72.0% |

| Promoter Holding | 0.00% |

This summary is for informational purposes only and not a recommendation to buy or sell.

Important Points

- Strong Growth: ROE of 26.7% and P/E of 8.86 indicate strong profitability.

- Attractive Valuation: Price to Book ratio of 1.49 suggests the stock is reasonably valued.

- High Public Interest: Around 72% of the holding is with public investors.

- Good Dividend: A 3.35% dividend yield offers steady income for investors.

- Strong Rural & Digital Reach: Wide presence across urban and rural India with strong digital platforms.

- Debt to Equity: At 6.33, it’s high but acceptable for a banking company.

Ujjivan Small Finance Bank shows 0.00% promoter holding – it’s important to understand what this means.

This is not necessarily a negative aspect, but investors should understand that the bank is now completely public and professionally managed, and not controlled by any single promoter group.

Sources: Screener

Disclaimer: The securities quoted are for illustration purposes only and are not recommendatory.

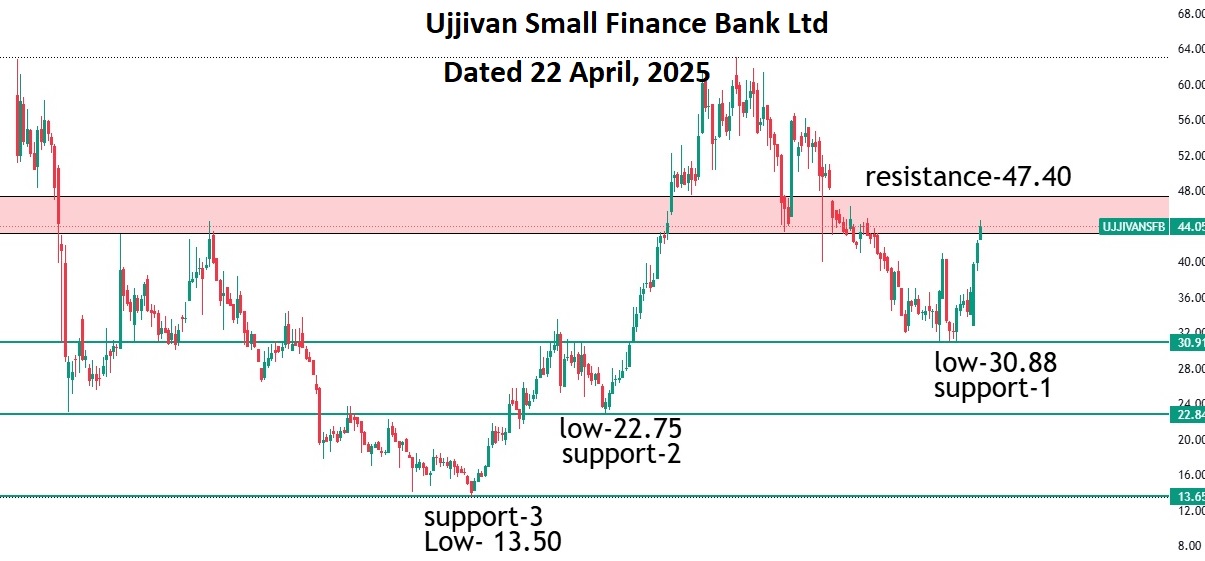

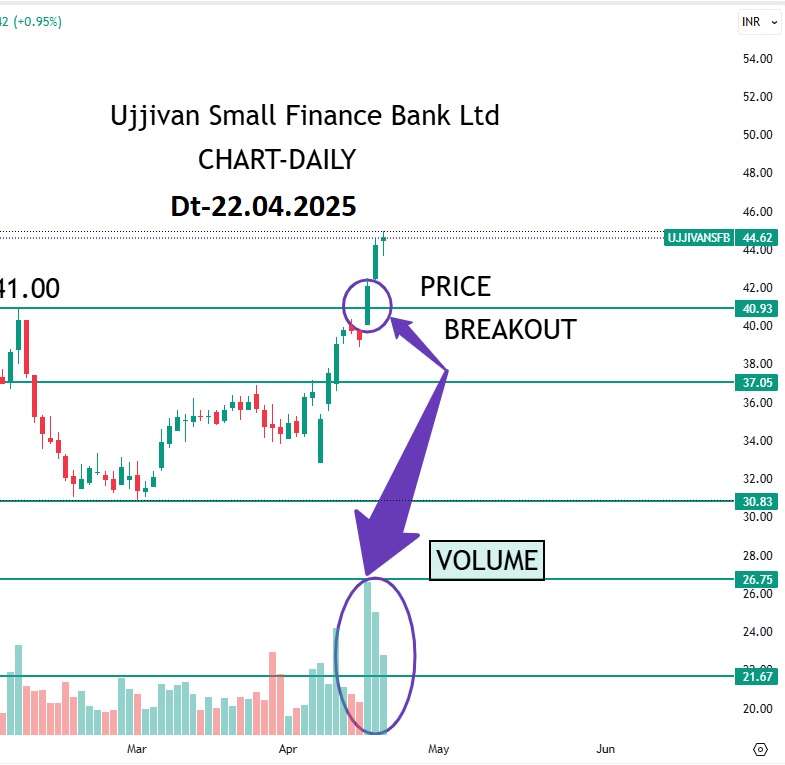

Chart Pattern Analysis – Weekly Time Frame

Ujjivan Small Finance Bank

Key Characteristics of This Pattern:

Updated: Data as of 22 April 2025

| Point | Description |

| Pattern Type | Consolidation‑Zone Breakout (Bullish continuation) |

| Consolidation Range | ₹30.00 – ₹41.00 |

| Breakout Level | Closed above ₹41.00 resistance on 15 Apr 2025 |

| Breakout Candle | Large bullish weekly candlestick breaking the top of the consolidation zone |

| Duration | 18 Nov 2024 to 15 Apr 2025 (~4 months 28 days) |

| Chart Type | Weekly Candlestick Chart |

| Psychology | Buyers gained confidence after multi‑month consolidation, signaling a shift to bullish momentum |

This summary is for informational purposes only and not a recommendation to buy or sell.

Ujjivan Small Finance Bank Ltd–MACD

Disclaimer: The securities quoted are for illustration purposes only and are not recommendatory.

MACD Analysis

- Bullish Crossover observed on the weekly chart.

- Histogram is expanding in green, confirming positive momentum.

- Signal indicates trend reversal from downtrend to uptrend.

- Strengthening buying pressure visible as MACD line is moving above the signal line.

Ujjivan Small Finance Bank Ltd–RSI

Disclaimer: The securities quoted are for illustration purposes only and are not recommendatory.

RSI Analysis (Daily Chart)

- RSI Value: 78.63

- Zone: Overbought (>70)

- Interpretation:

The stock has entered the overbought territory, suggesting a strong bullish momentum.

While this indicates high buying interest, it may also signal a possible short-term pullback or consolidation. - Market Sentiment:

Traders are showing strong confidence, but caution is advised for fresh entries.

Existing positions can consider trailing stop loss to protect gains.

Ujjivan Small Finance Bank Ltd–Stochastic

Disclaimer: The securities quoted are for illustration purposes only and are not recommendatory.

Major Support

When a price touches a level 3-4 times and bounces back upwards each time, this level becomes a strong support. If the price stays at the same place for a long time and the trading volume is also good there, then this support becomes even stronger.

or

When consolidation, resistance, and support all happen at the same level, it becomes a strong price zone and may act as a major support or resistance.

Moving Averages Overview (EMA)

Standard EMAs Used Globally and in India

| Time Frame-Short-Term |

| Common EMA Periods-5, 9, 13, 20, 26 |

| Usage-Retail traders & swing traders prefer these for short-term trend direction |

| Mid-Term |

| 50, 100 |

| Used to filter medium-term support/resistance |

| Long-Term |

| 150, 200, 240 |

| Institutional investors & foreign analysts track these for trend reversals & macro view |

Standard EMAs Used in TradingView (Free Version)

When it happens:

- Price: Trading above short-term and long-term EMAs (e.g., 20 EMA, 50 EMA, 100 EMA)

- Trend Indication: Strong bullish momentum

What it indicates:

When the stock price stays consistently above key moving averages, it suggests an uptrend is in place. This can act as a dynamic support, and traders may look for bullish entries on dips.

Example (from current chart):

Ujjivan Small Finance Bank Ltd is currently trading above 20 EMA, 50 EMA, and 100 EMA on the weekly chart. This alignment of EMAs below the price confirms a bullish structure and supports the ongoing upside momentum.

Why is Volume important in technical analysis?

Because volume confirms trends.

Rising price + high volume = Strong move

Rising price + low volume = Weak or unsustainable move

Types of Volume (Trading)

| Volume Term | Meaning |

| High Volume | Indicates strong buying or selling pressure; often supports breakouts. |

| Average Volume | Normal participation; useful for trend assessment during sideways markets. |

| Low Volume | Weak activity; unreliable for confirming trends or breakouts. |

| Good Volume | Healthy and consistent participation, often seen in trending markets. |

| More Than Average Volume | Stronger than usual; can signal potential breakout or increased interest. |

Frequently Asked Questions (FAQs) on Technical Analysis

RSI is above 78 — is it a sign of overbought or strength?

It indicates strength — high RSI is normal after strong breakouts.

The MACD crossover just happened — is it an early signal or confirmed reversal?

It’s a confirmed trend reversal — backed by price action and volume.

Is this the start of a multi-week rally or just a short-term move?

It may lead to a multi-week rally — strong base and breakout seen on the weekly chart.

Yearly Target Outlook (2025–2030)

Updated: April 2025

| Year | Target Range (₹) |

|---|---|

| 2025 | ₹48 – ₹62 |

| 2026 | ₹60 – ₹78 |

| 2027 | ₹72 – ₹95 |

| 2028 | ₹88 – ₹115 |

| 2029 | ₹98 – ₹130 |

| 2030 | ₹105 – ₹145 |

Note:

These targets are indicative and based on current technical & business trends.

Always consider macroeconomic conditions and RBI regulations before long-term investment.

Reassess the chart pattern every 3–6 months.

Target Calculation Using Fundamentals (EPS & PE Based)

To calculate Share Price Target for a company like Ujjivan Small Finance Bank, investors or analysts usually consider a combination of fundamental, technical, and macroeconomic factors. Here’s a simple breakdown of how targets are calculated (especially for long-term outlook like 2025–2030):

How to Calculate Share Price Target

| Fundamental Analysis (Example) |

| EPS (Earnings Per Share) |

| Check company’s current EPS and project it based on past CAGR (compound annual growth rate). |

| Example: If EPS today is ₹5.01 and expected to grow at 15% CAGR: |

| EPS in 2025=5.01×(1+0.15)1=₹5.76 |

| EPS in 2030=5.01×(1+0.15)6=₹10.06 |

| Target P/E Ratio |

| Use industry average or historical P/E ratio of the company. |

| Let’s say 13 is the expected P/E. |

| Target Price Formula |

| Target Price=EPS×P/E |

| 2030 Target=₹10.06×13=₹130.78 |

| Technical Analysis |

| Chart Patterns (Cup & Handle, Breakouts, etc.) |

| Indicators (MACD, RSI, Moving Averages) |

| Support/Resistance Levels |

| Use these to predict short-to-mid-term breakouts and estimate price ranges. |

| Growth Outlook |

| Loan Book Growth, Net Interest Margin, ROE, etc. |

| Consider regulatory, economic factors, and digital expansion strategy. |

| Sentiment & Market Conditions |

| IPO performance |

| FII/DII interest |

| Public sentiment, news impact |

| Conclusion: |

| Price Target = Estimated Future EPS × Expected Future P/E |

| This gives a fundamentally backed price estimate, then adjusted by technical signals and market sentiment for better accuracy. |

Conclusion-

Ujjivan Small Finance Bank Share Price Target 2025–2030:

Professionally Managed – No promoter holding, fully public & trusted.

Technical Signals Strong – Bullish breakout, MACD & RSI both support upside.

Fundamentals Solid – Serving 9M+ customers, strong digital growth.

Think Long-Term – Ideal for patient investors, not quick gains.

Do Your Research – Don’t follow the crowd, follow the facts.

Read More

Chambal Fertilisers Share Price Target 2025–2030

Nifty 50 Weekly Outlook – Important Update April 19, 2025

Nifty 50 Share Price Target 2025 |Crash or Recovery?

Silver Share Price Target 2025: Analysis and outlook

Gold Price Forecast 2025: अब सोने में निवेश करें या इंतजार ?

Crude Oil Share Price Target 2025| Analysis & Outlook

NSE Website update 2025: जानें Best फीचर्स और बदलाव

Intraday to Delivery: Avoid This Big Mistake!

ETFs Share Price Target 2025 – Buy Low, Sell High Strategy

Why Are ETFs Best for Swing Trading?

Are ETFs like mutual funds? free education 2025

ETF से Risk-Free कमाई के Best Secrets

Disclaimer: This blog is for educational purposes only I am just sharing my personal view as a trader and does not constitute financial advice. Please consult your financial advisor before making any trading or investment decisions. Trading in Equity market involves risk.The author shall not be held responsible for any profit or loss incurred as a result of acting on the information provided in this blog.

Welcome to Stock Overview! Expand your knowledge about the stock market and invest smarter. I started this channel to help everyone understand the basics of the stock market. When you meet a SEBI-registered advisor or a mutual fund distributor, you should be able to understand their suggestions clearly. This is only possible when you’ve done your minimum homework from your side. My goal is to empower you to make informed financial decisions confidently.

Contents

- 1 Company Overview – Ujjivan Small Finance Bank

- 2 Ujjivan Small Finance Bank Limited

- 3 How to Calculate Price and Percentage Change

- 4 Chart Pattern Analysis – Weekly Time Frame

- 5 Ujjivan Small Finance Bank Ltd–MACD

- 6 Ujjivan Small Finance Bank Ltd–RSI

- 7 Ujjivan Small Finance Bank Ltd–Stochastic

- 8 Major Support

- 9 Moving Averages Overview (EMA)

- 10 Why is Volume important in technical analysis?

- 11 Frequently Asked Questions (FAQs) on Technical Analysis

- 12 Yearly Target Outlook (2025–2030)

- 13 Target Calculation Using Fundamentals (EPS & PE Based)